(Seoul=Yonhap Infomax) Jang Won Lee – The recent sharp decline in Bitcoin prices has brought MicroStrategy Inc. (NASDAQ: MSTR)’s Bitcoin holdings close to breakeven, raising concerns over the company’s financial exposure.

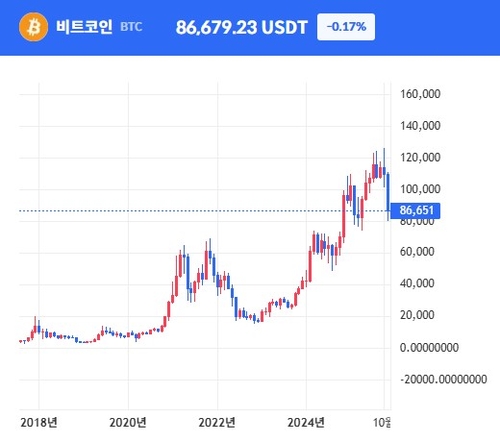

According to CoinDesk on the 23rd (U.S. local time), MicroStrategy’s average purchase price for its Bitcoin holdings stands at $74,400 (approximately 109.68 million won). Bitcoin experienced a steep drop last week, falling to as low as $82,194 at one point—just $8,000 above the company’s average acquisition cost.

As of 10:11 a.m. on the same day, Bitcoin was trading at $86,885 on Coinbase, according to Yonhap Infomax Crypto Dashboard (2550).

CoinDesk reported, “The plunge in Bitcoin has heightened market concerns that MicroStrategy may record book losses,” adding, “MicroStrategy’s common stock price has plummeted nearly 70% from last year’s peak, raising questions about the company’s ability to meet its financial obligations.”

However, as MicroStrategy has accumulated Bitcoin for over five years, a drop below $74,400 would not immediately trigger a margin call or forced liquidation.

The next significant structural pressure point for MicroStrategy’s balance sheet is expected around September 15, 2027.

On that date, holders of MicroStrategy’s $1 billion 0.625% convertible bonds will gain the right to exercise their put options at maturity.

These convertible bonds were issued when MicroStrategy’s stock was at $130.85, with a conversion price set at $183.19. Currently, MicroStrategy shares are trading around $170. If the stock remains below the conversion price of $183.19 in 2027, bondholders are likely to demand cash repayment rather than convert to equity.

In such a scenario, MicroStrategy would need to liquidate significant assets or secure additional funding.

Meanwhile, the performance of MicroStrategy’s four series of perpetual preferred shares issued this year has been mixed.

The STRF series, which pays a 10% fixed non-cumulative dividend, has delivered an 11% return over its issue price and is trading near $94. In contrast, the STRD series, offering a 10% fixed cumulative dividend, has posted a 22% loss, marking the weakest performance among the series.

jang73@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.