(Seoul=Yonhap Infomax) Hyun Woo Roh – South Korean government bond yields edged lower in morning trading on the 24th, with longer-dated bonds falling more than shorter maturities, resulting in a flatter yield curve.

The move tracked a modest decline in US Treasury yields during the previous session.

According to the Seoul bond market, as of 11:05 AM KST, the yield on the three-year government bond stood at 2.862%, down 1.1 basis points from the previous session’s private sector assessment. The 10-year yield fell 2.5 basis points to 3.250%.

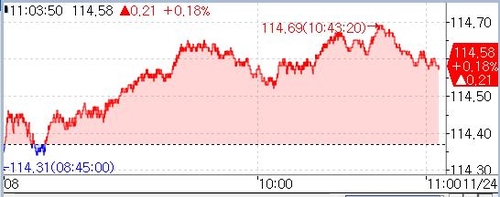

Three-year KTB futures rose 5 ticks to 105.95, with foreign investors net selling approximately 603 contracts and financial investment firms net buying 2,400 contracts. Ten-year KTB futures gained 22 ticks to 114.59, as financial investment firms sold about 2,000 contracts and banks purchased 1,900 contracts. Thirty-year KTB futures advanced 0.52 points to 134.36, with 56 contracts traded.

Afternoon Outlook

Market participants expect the bullish trend to continue, particularly in the mid- to short-term segment. “Concerns in the FX market are easing, as seen in the slight decline in the won, which is a positive sign ahead of the Monetary Policy Board meeting,” said a bond manager at an asset management company.

However, a bond dealer at a securities firm noted, “With the economy improving and less need for rate cuts, further gains may be limited. We are cautious about taking aggressive positions.”

Intraday Developments

The three-year benchmark KTB (issue 25-4) opened at 2.856%, down 1.7 basis points from the previous session’s private sector rate. The 10-year benchmark KTB (issue 25-5) started at 3.274%, down 0.1 basis points.

In the US, the two-year Treasury yield fell 2.5 basis points to 3.5100%, while the 10-year yield dropped 2.1 basis points to 4.0650%.

Dovish comments from John Williams, President of the Federal Reserve Bank of New York, contributed to the decline in yields. Speaking at the Central Bank of Chile’s centennial conference in Santiago on the 21st, Williams said, “I still see the possibility of further adjustments to the federal funds rate target range in the near term to move policy closer to neutral.”

KTB futures opened slightly higher, reflecting the drop in US yields. Market sentiment remained cautious, with participants closely watching the USD/KRW exchange rate and the KOSPI index. The dollar-won rate fell to the low 1,470s, while South Korea’s benchmark KOSPI index rose about 1%.

Foreign investors capped further gains by net selling KTB futures from the start of the session, offloading around 500 contracts in the three-year and over 300 contracts in the 10-year futures.

In a separate auction, 1 trillion won ($845 million) of 91-day Monetary Stabilization Bonds were awarded at a yield of 2.300%, with bids totaling 19.3 trillion won ($16.3 billion).

With Japanese financial markets closed for the Labor Thanksgiving Day substitute holiday, external influences on the Seoul bond market were limited.

Trading volume for three-year KTB futures reached about 64,000 contracts, with open interest increasing by 2,300 contracts. Ten-year KTB futures saw 35,000 contracts traded, while open interest declined by 1,100 contracts.

*

hwroh3@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.