(Seoul=Yonhap Infomax) Ji Yeon Kim – The dollar-won exchange rate trimmed earlier losses and continued to trade sideways in the mid-1,470 won range, as settlement demand and regulatory caution limited further declines.

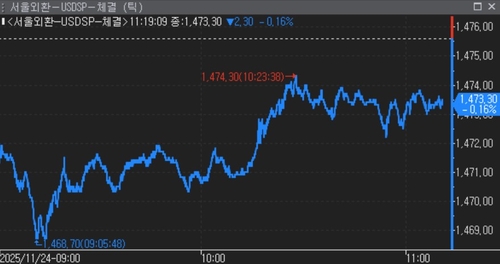

As of 11:19 AM KST on the 24th in the Seoul foreign exchange market, the dollar-won was trading at 1,473.30 won, down 2.30 won from the previous session.

The pair opened at 1,472.00 won, down 3.60 won from the previous day.

Expectations for a potential Federal Reserve rate cut in December and comments from a Bank of Japan policy board member leaving the door open for future rate hikes contributed to downward pressure on the dollar-won.

South Korea’s benchmark KOSPI index rose over 1%, with foreign investors net buying local equities, pushing the dollar-won to an intraday low of 1,468.70 won in early trading.

However, a slight uptick in the dollar index during Asian trading prompted the dollar-won to pare some of its losses.

The dollar-yen rebounded, recovering last Friday’s losses and further limiting the downside for the dollar-won.

The dollar-won briefly touched an intraday high of 1,474.30 won, but further gains were capped by speculation that authorities might intervene in the market.

According to major foreign media, the United States reportedly requested $400 billion in investment from Taiwan during trade negotiations, a figure higher than what was asked of South Korea.

Sources said the U.S. asked Taiwan for an investment amount between the $350 billion and $550 billion pledged by South Korea and Japan, respectively. The $165 billion investment by Taiwan Semiconductor Manufacturing Co. (TSMC) in the U.S. is included in this figure.

Following this news, the Taiwan dollar rose to the 31.4 level against the U.S. dollar during intraday trading.

Meanwhile, the U.S. State Department and Ukraine issued a joint statement, saying, “Both delegations have drafted an updated and refined peace framework.” The draft reportedly includes provisions for Ukraine to cede the entire Donbas region (Donetsk and Luhansk) to Russia and reduce its military to 600,000 troops.

South Korean shipbuilders also announced new orders. Hanwha Ocean disclosed a contract worth 757.7 billion won ($570 million) to build four very large crude carriers (VLCCs) for an African client. HD Korea Shipbuilding & Offshore Engineering announced orders for six container ships from HMM Co., Ltd. worth 1.6037 trillion won ($1.21 billion) and two additional vessels worth 534.6 billion won ($400 million), totaling 2.1383 trillion won ($1.61 billion).

Japan’s financial markets were closed for Labor Thanksgiving Day.

Later tonight, the U.S. will release the Chicago Fed National Activity Index for October and the Dallas Fed Manufacturing Activity Index for November.

The People’s Bank of China set the dollar-yuan central parity rate at 7.0847 yuan, a 0.04% appreciation from the previous session.

The dollar index rose to 100.26.

Foreign investors were net sellers of about 200 contracts in the dollar futures market.

Afternoon Outlook

FX dealers expect the dollar-won to face resistance above the mid-1,470 won level in the afternoon session.

“The won is relatively weak today, and settlement demand has pushed the exchange rate higher,” said a foreign bank FX dealer. “However, it seems difficult for the pair to move significantly higher from here.”

“Authorities appear to be guiding the exchange rate toward a stronger won, so the upside is likely to be limited,” the dealer added.

Another bank dealer noted, “Despite a general risk-off mood, the dollar’s strength has not been pronounced. With some dollar selling interest around the 100 level on the dollar index, the dollar-won’s further upside is limited.”

Intraday Trends

The dollar-won opened down 3.60 won, tracking declines in the New York non-deliverable forward (NDF) one-month contract.

The intraday high was 1,474.30 won, and the low was 1,468.70 won, resulting in a trading range of 5.60 won.

Foreign investors were net buyers of 62 billion won ($47 million) in the KOSPI market and net sellers of 167.8 billion won ($126 million) in the KOSDAQ market.

According to Yonhap Infomax’s estimated trading volume (screen number 2139), as of the current time, turnover stood at approximately $5.4 billion.

The dollar-yen was trading at 156.644 yen, up 0.271 yen from the New York session, while the euro-dollar was at 1.15140, down 0.00022.

The yen-won cross rate was 940.01 won per 100 yen, and the yuan-won rate was 207.19 won.

The offshore dollar-yuan (CNH) rate rose to 7.1086 yuan.

jykim2@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.