(Sejong=Yonhap Infomax) Eun Byul Yun = The Korea Institute for Industrial Economics and Trade (KIET), a state-run think tank, projects South Korea's economy will grow by 1.9% in 2025, with domestic demand expected to offset sluggish exports.

Domestic Demand to Drive Growth Despite Export Weakness

In its "2026 Economic and Industrial Outlook" released on the 24th, KIET forecasts South Korea's annual GDP growth rate at 1.9% for 2025, up from this year's estimate of 1.0% and in line with the nation's potential growth rate. The institute expects growth of 2.2% in the first half and 1.5% in the second half of next year.

The projections are based on assumptions of international oil prices at $59 per barrel and a USD/KRW exchange rate around 1,390.

KIET noted, "While uncertainties stemming from U.S.-led trade disputes persist and exports are set to decline slightly due to base effects from last year's strong performance, robust consumption and the government's expansionary fiscal stance will provide momentum for domestic growth."

Private consumption is forecast to rise 1.7% in 2025, supported by stabilizing inflation and interest rates, increased real and household incomes, and government support measures.

Facility investment is expected to grow 1.9% as corporate financing conditions improve and demand for advanced industries, including AI, remains strong.

Construction investment is projected to increase 2.7%, driven by stabilized construction material costs and expanded government spending on social overhead capital (SOC). However, accumulated unsold housing inventory and a decline in new housing supply are cited as constraints.

Exports are expected to contract 0.5% to $697.1 billion, while imports are projected to fall 0.3% to $629.6 billion. After surpassing $700 billion for the first time this year, exports are forecast to dip below that threshold in 2025. The trade surplus is projected at $67.5 billion next year.

Key external variables for the domestic economy in 2025 include the macroeconomic impact of U.S. tariffs, the sustainability of the AI-driven ICT upcycle, and financial market volatility stemming from fiscal and monetary policy shifts in major economies. Domestically, the strength and persistence of the consumption recovery and the extent of export slowdown warrant close attention.

U.S. Tariffs to Weigh on Exports—Second Half Downturn Expected

KIET anticipates that U.S. tariffs and ongoing U.S.-China trade tensions will pressure South Korean exports in 2025. The export outlook is particularly bearish for the second half, with exports expected to grow 2.9% in the first half but decline 3.6% in the latter half.

The outlook incorporates a survey of 143 domestic economic and industry experts, who identified global trade paradigm shifts as the most likely external risk for 2025, followed by exchange rate volatility and a global economic slowdown.

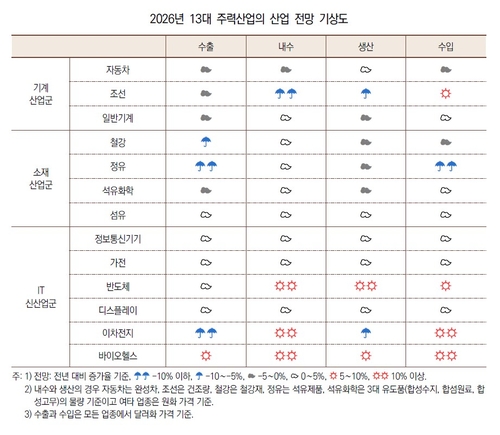

Mixed Outlook Across Key Industries—Semiconductors and Shipbuilding Strong, Autos and Steel Weak

Among major industries, the outlook remains subdued for automobiles, steel, petrochemicals, and refining—sectors with high U.S. exposure or persistent market weakness. Steel is expected to struggle with global oversupply, making it difficult to offset weak domestic demand through exports. Refining is likely to be hit by falling oil prices, while petrochemicals face continued low growth and profitability due to stagnant exports and domestic demand.

KIET stated, "Automobiles and textiles may see stagnant growth, while steel, petrochemicals, and refining are likely to remain in a mild downturn. Although domestic demand for secondary batteries is rising, the high share of overseas production means export and domestic output will remain subdued."

Conversely, semiconductors, ICT devices, shipbuilding, and biohealth are expected to maintain growth momentum. Semiconductor exports are forecast to rise 4.7% in 2025, though this is below this year's projected 16.6% surge. The current upcycle is expected to moderate in the second half, falling short of 2024 levels. Shipbuilding is set to benefit from increased orders for LNG and LPG carriers and accelerated overseas expansion.

However, concerns are mounting over South Korea's growing dependence on semiconductors. Kwon Nam-hoon, President of KIET, said, "Our economy is becoming increasingly reliant on semiconductors, while the competitiveness of other core industries faces significant challenges. This is not only a concern for next year but also a long-term issue. 2025 should be a year to restore industrial competitiveness."

ebyun@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.