(Seoul=Yonhap Infomax) Jee Hyun Son — Barclays anticipates a high likelihood of a rate cut at the Bank of Korea’s Monetary Policy Committee (MPC) meeting in November.

In a preview report released on the 24th, Barclays researcher Beom Ki Son stated, “The November MPC decision is expected to mark the end of the prolonged rate freeze that has persisted since the May meeting.” He added, “With two MPC members likely to vote against a cut, the decision is expected to be closely contested.”

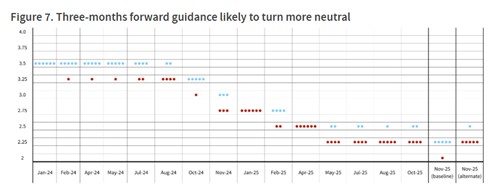

Barclays expects MPC members to adopt a more neutral stance in their forward guidance.

Son noted, “One MPC member is expected to leave the door open for a rate cut within the next three months, while the remaining five are likely to favor holding rates steady.”

However, given the likelihood of a tight vote at the November meeting, Son added that a decision to keep rates unchanged remains possible.

He further commented, “There is also an alternative scenario in which one or two MPC members advocate for a cut and oppose a hold, while four or five members keep the possibility of a rate cut within the next three months open.”

Barclays raised its 2025 GDP growth forecast for South Korea from 1.6% to 1.8%.

“Excluding the semiconductor sector, next year’s growth is projected at 1.1%,” Son said, adding, “Domestic demand is expected to remain sluggish.”

jhson1@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.