(Seoul=Yonhap Infomax) Jang Won Lee—China has witnessed a sharp increase in inflows into gold exchange-traded funds (ETFs) this year, fueling a rally in gold prices, according to an analysis by ETF.com on the 21st (U.S. local time).

According to the World Gold Council (WGC), net inflows into mainland China's gold ETFs reached $13.7 billion (approximately 20.21 trillion won) from the start of the year through the end of October.

This marks the second-largest inflow among all countries globally.

As a result of these substantial inflows, the total assets under management (AUM) of Chinese gold ETFs expanded to $31.4 billion.

This places China fifth in the global gold ETF market, following the United States, United Kingdom, Switzerland, and Germany.

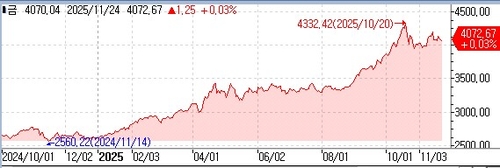

Gold prices have surged 55% year-to-date, marking the largest annual gain since 1979.

As of 14:30 on the 24th, spot gold was trading at $4,046.52 on the London OTC market.

WGC cited several factors behind the surge in Chinese gold demand:

- Rapid rally in gold prices

- Escalating U.S.-China trade tensions

- Uncertainty over China's economic growth outlook

Regulatory changes allowing Chinese insurers to invest in gold for the first time this year have also emerged as a potential driver of future demand.

China and India have traditionally been the largest physical gold consumers, accounting for about a quarter of global jewelry and bar-and-coin demand.

In the first three quarters of this year alone, China purchased 321.6 tons of physical gold, valued at approximately $41.4 billion.

Meanwhile, the United States maintained a commanding lead in the global gold ETF market.

Year-to-date, net inflows into U.S. gold ETFs—including SPDR Gold Shares (AMS:GLD) and iShares Gold Trust (AMS:IAU)—totaled approximately $43.3 billion.

Total assets in U.S. gold ETFs reached $258 billion.

jang73@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.