(Seoul=Yonhap Infomax) Yoon Woo Shin – The dollar-won exchange rate climbed to the upper 1,470-won range on continued foreign investor outflows from South Korea’s stock market.

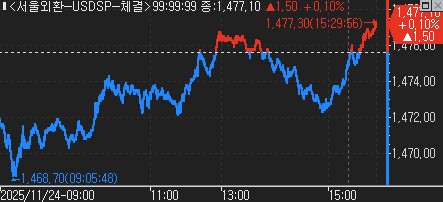

As of 15:30 KST on the 24th, the dollar-won closed regular trading at 1,477.10 won, up 1.50 won from the previous session at the Seoul foreign exchange market.

The pair opened at 1,470.00 won, down 3.60 won from the previous close, but steadily pared losses throughout the session.

After moving into flat territory in the afternoon, the rate briefly dipped before rebounding to end higher.

Persistent net selling of Korean equities by foreign investors fueled custodial dollar demand, pushing the dollar-won higher.

Foreign investors net sold over 400 billion won ($308 million) of stocks on the Korea Exchange’s main board (KOSPI) on the day, extending the selling streak after offloading more than 2.8 trillion won ($2.16 billion) in the previous session on the 21st.

While the recent dollar strength and yen weakness that had driven the dollar-won higher showed signs of easing, subdued exporter dollar selling and steady settlement demand encouraged further upside in the pair.

The dollar index and dollar-yen also reversed earlier losses in Asian trading, providing additional support for the dollar-won.

However, upside was capped by heightened vigilance from authorities at higher levels and the possibility of currency hedging by the National Pension Service (NPS).

There was little appetite for an aggressive break above the 1,480-won threshold.

On the corporate front, HD Korea Shipbuilding & Offshore Engineering Co. announced it had secured an order for eight container ships from HMM Co. worth approximately 2.13 trillion won ($1.64 billion).

Hanwha Ocean Co. disclosed a contract to build four very large crude carriers (VLCCs) for an African shipowner, valued at 757.7 billion won ($583 million).

Japan’s financial markets were closed for Labor Thanksgiving Day.

Later tonight, the Federal Reserve Bank of Dallas will release its November manufacturing activity index.

In the currency futures market, foreign investors net bought around 24,000 dollar contracts.

The People’s Bank of China set the yuan stronger, fixing the dollar-yuan reference rate at 7.0847 yuan, down 0.0028 yuan (0.04%) from the previous session.

Outlook for Next Trading Day

FX dealers noted that while the market recognizes the current high levels, the upside remains open.

“There was exporter dollar selling in the morning, but this faded in the afternoon as settlement demand picked up, tilting the balance toward dollar buying,” said a bank dealer. “Unless authorities or the NPS intervene, the downside will likely remain supported.”

He added, “There is caution around the 1,480-won level, so a sharp move higher is unlikely. To break below 1,460 won, new catalysts would be needed. While expectations for a U.S. rate cut have increased, the Federal Reserve remains divided, making a decisive cut difficult to anticipate.”

Another dealer commented, “With 1,480 won seen as the upper bound and dollar strength persisting, exporters seem reluctant to sell at these levels.”

He continued, “Although hopes for a U.S. rate cut in December have grown, it’s not enough to bet on a weaker dollar. There are also few factors supporting a stronger won, so the dollar-won uptrend is expected to continue.”

Intraday Market Trends

The dollar-won opened at 1,470.00 won, down 3.60 won from the previous session, tracking a decline in the New York non-deliverable forward (NDF) one-month dollar-won contract.

During the session, the high was 1,477.30 won and the low was 1,468.70 won, with an intraday range of 8.60 won.

The market average rate (MAR) is set to be announced at 1,473.50 won.

Spot FX trading volume, combining Seoul Money Brokerage Services and Korea Money Brokerage Corp., totaled $9.201 billion.

South Korea’s benchmark KOSPI index closed down 0.19% at 3,846.06, while the KOSDAQ fell 0.87% to 856.44.

Foreign investors net sold 424.9 billion won ($327 million) of KOSPI stocks and 39.4 billion won ($30 million) of KOSDAQ shares.

Near the close of the Seoul FX market, the dollar-yen stood at 156.633 yen, and the yen-won cross rate was 942.69 won per 100 yen.

The euro-dollar rate was 1.15220, and the dollar index was at 100.146.

The offshore dollar-yuan (CNH) rate was 7.1064 yuan.

The direct yuan-won rate closed at 207.80 won per yuan, with an intraday low of 206.81 won and a high of 207.84 won.

Combined trading volume at Korea Money Brokerage Corp. and Seoul Money Brokerage Services reached 19.038 billion yuan.

*

ywshin@yna.co.kr

(End)

Exchange Rate Data Table

| Date | Exchange Rate (CNY/USD) |

|---|---|

| 2025-11-24 | 7.0847 |

Trend Analysis: The dollar-won exchange rate remains elevated amid persistent foreign equity outflows and strong dollar demand. The pair is testing the upper 1,470-won range, with 1,480 won acting as a key resistance level. Market participants expect the uptrend to continue unless new catalysts emerge to support the won or weaken the dollar.

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.