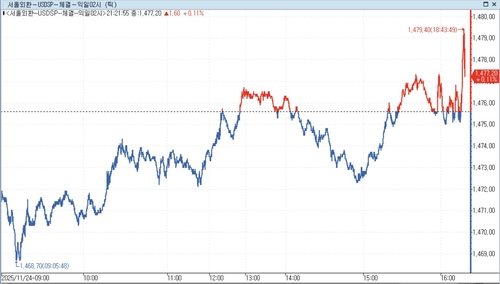

(Seoul=Yonhap Infomax) Seon Mi Jeong—The dollar-won exchange rate edged higher in after-hours trading, approaching the 1,480 won level.

Despite a slightly weaker U.S. dollar, the Korean won tracked declines in other Asian currencies such as the Japanese yen and Chinese yuan.

As of 21:29 KST on the 24th, the dollar-won rate was quoted at 1,476.80 won, up 1.20 won from the previous session.

During extended trading, the rate briefly touched 1,479.40 won, threatening the 1,480 won mark. This is the highest level since April 9, when it reached 1,487.60 won.

The official closing price at 15:30 KST was 1,477.10 won.

In overnight trading, the U.S. Dollar Index slipped slightly, trading around 100.08.

The renewed weakness in the dollar appears to be driven by comments from John Williams, President of the Federal Reserve Bank of New York, who reignited expectations for a rate cut in December.

However, the dollar-yen rate rebounded, rising to the upper 156 yen range and hitting a session high of 156.939 yen.

The offshore dollar-yuan rate also remained firm, trading in the 7.10 yuan range.

Meanwhile, a U.S. delegation visiting Europe to discuss a peace framework for Ukraine is reportedly set to meet separately with Russian officials.

Russia stated it has not yet received detailed information on the Ukraine peace plan discussed by the U.S. and Ukraine in Geneva, Switzerland.

Key U.S. economic data scheduled for release in overnight trading includes the Dallas Fed's November manufacturing activity index.

Three-month and six-month Treasury bill auctions are also set to take place.

At the same time, the dollar-yen rate was quoted at 156.810 yen, up 0.431 yen from the New York session, while the euro-dollar rate stood at 1.15410, up 0.00240 dollars.

The yen-won cross rate was 941.73 won per 100 yen, and the yuan-won rate was 207.8 won.

The offshore dollar-yuan (CNH) rate was recorded at 7.105 yuan.

smjeong@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.