(Seoul=Yonhap Infomax) Sung Jin Kim—

The US Treasury's latest auction of 2-year notes saw robust demand, with the yield set in line with market expectations.

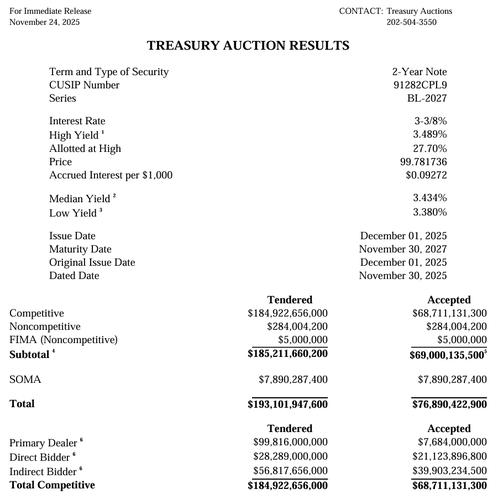

The US Treasury Department announced on the 24th (local time) that it had sold $69 billion of 2-year Treasury notes at a yield of 3.489%. This marks a decline of 1.5 basis points from last month's auction yield of 3.504%, representing the lowest level since August 2022.

The bid-to-cover ratio reached 2.68, up from 2.59 in the previous auction and above the six-month average of 2.59, indicating stronger investor appetite.

The awarded yield matched the when-issued trading yield, signaling that the result was in line with market expectations.

Indirect bidding, a proxy for foreign investor demand, rose 4.4 percentage points to 58.1% compared to the previous month. Direct bidding fell by 4.1 percentage points to 30.7%.

The share of the auction absorbed by primary dealers decreased by 0.4 percentage points to 11.2%.

Following the auction results, the 2-year Treasury yield in the secondary market showed little reaction, remaining near pre-auction levels in early afternoon New York trading.

sjkim@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.