(Seoul=Yonhap Infomax) Yun Gu Lee – At the end of the third quarter this year, South Korean insurance companies saw their outstanding loan balances decrease by approximately 4 trillion won ($3.1 billion) compared to the previous quarter, while the delinquency rate for household loans increased.

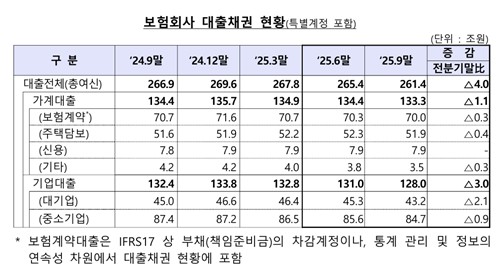

According to data released by the Financial Supervisory Service (FSS) on November 25 regarding insurance companies’ loan receivables as of end-September 2025, the total outstanding balance stood at 261.4 trillion won ($202.5 billion), down 4 trillion won from the previous quarter.

Household loan balances declined by 1.1 trillion won to 133.3 trillion won ($103.2 billion), while corporate loans contracted by 3 trillion won to 128 trillion won ($99.3 billion).

The overall delinquency rate—measured as loans overdue by more than one month—stood at 0.81%, a decrease of 0.02 percentage points from the previous quarter. However, the household loan delinquency rate rose by 0.05 percentage points to 0.85%, while the corporate loan delinquency rate fell by 0.05 percentage points to 0.79%.

Excluding mortgage loans, the delinquency rate for household loans reached 2.94%, up 0.37 percentage points from the previous quarter and 0.97 percentage points from the same period last year.

The delinquency rate for large corporate loans increased by 0.01 percentage points to 0.72%. Notably, Homeplus loan receivables have been classified as delinquent since the second quarter of this year, causing the rate to surge to 0.71% at end-June and remain at a similar level.

The non-performing loan (NPL) ratio—calculated as substandard or below loans divided by total loans—stood at 0.98%, down 0.02 percentage points from the previous quarter. The NPL ratio for corporate loans fell by 0.07 percentage points to 1.13%, while the ratio for household loans rose by 0.06 percentage points to 0.67%. Excluding mortgage loans, the NPL ratio for household loans increased by 0.41 percentage points from the previous quarter and 1.10 percentage points year-on-year to 2.50%.

Among large corporations, the NPL ratio worsened by 0.12 percentage points to 1.07% compared to the previous quarter, while for small and medium-sized enterprises (SMEs), it improved by 0.16 percentage points to 1.17%.

Although some asset quality indicators showed slight improvement, the FSS noted that risks remain due to delayed economic recovery. The regulator plans to guide insurance companies to strengthen their loss-absorbing capacity and enhance risk management in anticipation of potential increases in delinquencies and non-performing loans.

yglee2@yna.co.kr

(End)

© Yonhap Infomax. All rights reserved. Unauthorized reproduction or redistribution, and AI learning or utilization, are strictly prohibited.

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.