(New York=Yonhap Infomax) Jeong Ho Jin — Nvidia Corp. (NASDAQ: NVDA), the leading US artificial intelligence (AI) chipmaker, has issued a detailed rebuttal to mounting 'AI bubble' concerns in a recent shareholder letter, addressing skepticism that has persisted despite the company’s stronger-than-expected third-quarter results.

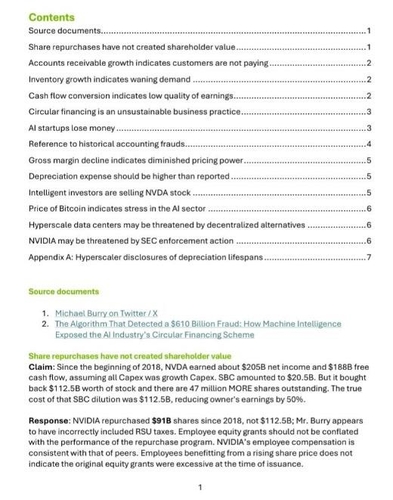

According to the tech industry, Nvidia recently distributed a seven-page document titled “Fact Check FAQ” to shareholders, systematically countering more than ten allegations related to the so-called AI bubble and the company’s financial health.

Addressing criticism over rising accounts receivable and potential collection issues in Q3, Nvidia stated, “Days sales outstanding (DSO) stood at 53 days, virtually unchanged from the long-term average of 52 days, and even lower than the previous quarter.” The company emphasized, “There are almost no overdue receivables, and there is insufficient evidence to suggest collection problems or customer defaults.”

However, Nvidia’s Q3 accounts receivable surged 88.7% year-on-year, though the figure declined quarter-on-quarter.

Regarding increased inventory, Nvidia explained that the buildup is in preparation for its next-generation AI chip, Blackwell. “Inventory rose 32%, but this is to support the Blackwell product launch and is unrelated to demand slowdown or customer payment issues,” the company said. Nvidia added, “With Q4 revenue guidance expected to reach $65 billion, securing inventory is essential given production considerations.”

On cash flow concerns, Nvidia noted, “AI startups require significant upfront investment, which can temporarily impact short-term cash flow, but the addressable market is vast.” The company disputed claims of a 75% cash conversion rate, calling it “based on incorrect data.” Nvidia clarified, “Actual operating cash flow (OCF) was $23.8 billion, not $14.5 billion, and free cash flow (FCF) over the past year reached $77.2 billion—about 78% of net income—demonstrating far stronger cash generation than peers such as TSMC and Intel.”

Addressing gross margin controversy, Nvidia said its gross margin improved quarter-on-quarter, noting confusion arose from year-on-year comparisons.

On Wall Street’s recent debate over depreciation of Nvidia’s AI chips, the company stated its depreciation periods are in line with industry standards: “Equipment is depreciated over 2–7 years, buildings over 30 years, and server equipment over 4–6 years, similar to Google, Amazon, and Meta. GPUs are often used for more than six years.”

Nvidia also addressed concerns over its circular financial structure, following criticism that investments in customers such as OpenAI could be a form of ‘round-tripping’ to boost sales. “Revenue from AI startups we invest in is mostly based on third-party customers, so our investment funds do not simply return as Nvidia chip purchases,” the company said. “Investments in these firms account for only 3–7% of total revenue, making it difficult to classify as artificial sales.”

Nvidia further stated, “We do not inflate profits by capitalizing expenses like WorldCom, nor do we engage in vendor financing like Lucent. Payments from customers are collected immediately upon shipment.”

Finally, Nvidia addressed rumors of a US Securities and Exchange Commission (SEC) investigation, saying, “We have not received any notification or indication of such an inquiry and are in full compliance with regulations.”

jhjin@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.