(Seoul=Yonhap Infomax) Sung Jin Kim—Government bond futures climbed in overnight trading as expectations grew that the US Federal Reserve will cut rates again next month.

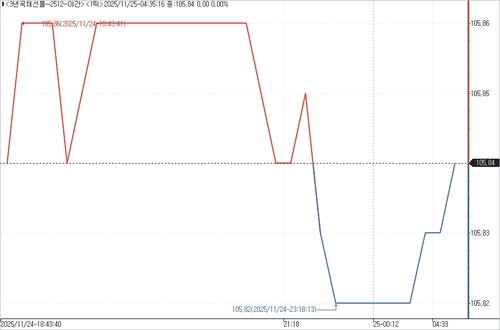

According to the Seoul bond market on the 25th, the 3-year government bond futures closed at 105.84 in overnight trading, up 3 ticks from the previous day’s regular session close. Foreign investors and financial institutions were net buyers of 18 and 14 contracts, respectively, while individuals were net sellers of 32 contracts.

The 10-year government bond futures ended 16 ticks higher at 114.34. Foreign investors were net buyers of 3 contracts, while individuals were net sellers of 3 contracts.

Trading volume for the 3-year contract surged to 129 contracts from 8 in the previous session. In contrast, 10-year contract volume shrank to 6 from 81.

As of 06:22 KST, US Treasury yields were trending lower. The 10-year US Treasury yield fell 3.40 basis points from the previous New York session close, while the 30-year yield dropped 3.90 basis points. The 2-year yield declined by 0.90 basis points.

Dovish comments from Federal Reserve officials supporting a rate cut next month have pushed the probability of a cut priced into the futures market above 80%. With the Fed’s “blackout period” on policy commentary set to begin on Saturday, the dovish camp appears to be consolidating its position.

Fed Governor Christopher Waller said in an early morning Fox Business interview in New York, “My main concern regarding our dual mandate (price stability and full employment) is the labor market,” adding, “I support a rate cut at the next meeting.”

Mary Daly, President of the Federal Reserve Bank of San Francisco, also expressed support for a rate cut next month in an interview with foreign media.

sjkim@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.