(Seoul=Yonhap Infomax) Sang Min Han = Moody's Investors Service announced it will maintain its 'Negative' outlook for South Korea's banking sector in 2025, extending its bearish stance from this year.

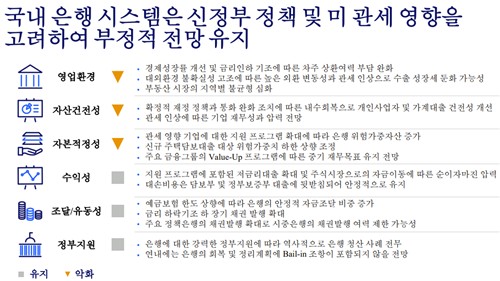

At a media briefing jointly hosted by Moody's and Korea Investors Service on the 'Credit Outlook for Korean Financial Institutions and Non-Financial Corporates' held on the 24th, Moody's stated, "The outlook for the domestic banking system remains negative into 2025, reflecting potential deterioration in the operating environment and capital adequacy."

Jung Min Son, analyst at Moody's, explained that the continued negative outlook is due to "persistent uncertainty in the external environment, including heightened foreign exchange volatility and the risk of slower export growth stemming from US tariff policies," despite expectations for improved GDP growth and a lower interest rate trajectory.

Moody's projects that the operating environment, asset quality, and capital adequacy of South Korean banks will all face downward pressure in the coming year.

Son noted that while asset quality for loans to individuals and small business owners may improve on the back of expansionary fiscal policy and a recovery in domestic demand, the profitability of corporate borrowers could weaken due to higher US tariffs, negatively impacting banks' credit profiles.

Regarding capital adequacy, Son added, "There is a likelihood of increased risk-weighted assets (RWA) as banks expand support programs for productive finance and companies affected by tariffs. The impact of higher risk weights on new mortgage loans has also been factored in."

The South Korean government continues to emphasize productive and inclusive finance while implementing policies to curb household debt.

Despite pressure on net interest margins (NIM), Moody's expects banks' overall profitability to remain stable, supported by steady credit costs.

Moody's also highlighted that commercial real estate (CRE) exposures remain a key risk to asset quality for banks across the Asia-Pacific region.

The agency further noted that weakened expectations for the timing and frequency of interest rate cuts are limiting downside support for the banking system's credit fundamentals.

"Downside risks stemming from uncertainties in tariff and trade policy, FX volatility, and economic growth have been incorporated into the negative outlook," Son said. "The diminished expectation for rate cuts is also a factor supporting the negative view."

Korea Investors Service expects domestic rate cuts to pause soon, with card companies and capital firms particularly vulnerable to higher rates. Hyung Seok Kim, head of division at Korea Investors Service, commented, "Card and capital companies, which rely on market funding, are highly sensitive to interest rates and will be significantly affected. The impact on corporate earnings will also influence profitability and asset quality."

*

smhan@yna.co.kr

(End)

© Yonhap Infomax. All rights reserved. Unauthorized reproduction, redistribution, or AI training/use is strictly prohibited.

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.