(Seoul=Yonhap Infomax) Pil Joong Jeong –

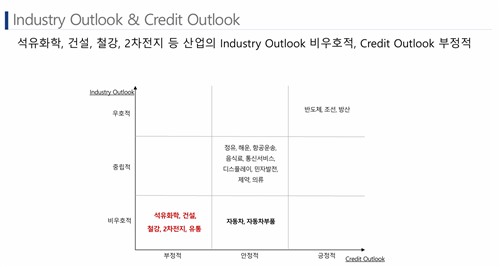

Petrochemicals, Construction, Steel, and Secondary Batteries Remain Weak

AI Boom Presents Opportunities for Power, Telecom; Defense Industry Also Seen as Mid-to-Long-Term Beneficiary

South Korea’s persistently high exchange rate could further increase the burden on outbound investments to the United States, according to recent forecasts.

While the overall trend of corporate credit downgrades in South Korea is expected to ease compared to previous years, sectors such as petrochemicals and construction are likely to continue facing headwinds. Industries related to artificial intelligence (AI) and defense are identified as potential mid-to-long-term beneficiaries.

“US Investments Face Exchange Rate Headwinds—Limited Incentive for Domestic Rate Cuts”

Kwon Ki-hyuk, Head of Corporate Ratings at Korea Ratings, stated at the “Moody’s-Korea Ratings Media Briefing” on the 24th, “The KRW-USD exchange rate has remained above the mid-1,400 won level for some time. While a stronger won benefits exporters, it weakens purchasing power and dampens domestic demand and investment, posing a significant burden.”

He added, “With both the government and corporates planning to expand investments in the US, this could become an even greater challenge going forward.”

According to Yonhap Infomax Dollar-Won Market Summary (Screen No. 2110), the USD/KRW exchange rate closed at 1,477.10 won on the 24th. After surpassing the 1,400-won mark at the end of September, the rate has continued to climb.

Factors such as the Korea-US interest rate gap, increased domestic liquidity, and active overseas investments have contributed to the sharp rise in the exchange rate, amplifying the burden of US-bound investments.

Kwon also noted that there are various domestic variables affecting interest rates, making a sustained rate-cutting stance unlikely. “In Korea, monetary policy must address not only traditional issues like inflation and economic growth, but also real estate and exchange rate concerns. Thus, there is limited pressure to maintain a rate-cutting bias,” he said. “Expectations of increased government bond issuance due to US investments have made the market particularly sensitive to comments from the Bank of Korea governor.”

Negative Outlook Persists for Petrochemicals, Construction; AI and Defense Sectors Show Promise

Considering the proportion of positive and negative credit outlooks for domestic companies this year, the downward trend in credit ratings is expected to moderate next year.

As of the end of September, Korea Ratings reported 12 companies with positive or upgrade reviews and 13 with negative or downgrade reviews, compared to last year’s 8 positive and 26 negative reviews, indicating a slight easing of the downgrade trend.

“If we predict next year’s rating changes based on the year-end ratio of positive and negative outlooks, the downgrade trend could ease in 2025,” Kwon said.

However, the outlook for sectors facing unfavorable conditions remains largely unchanged. Petrochemicals, construction, steel, and secondary batteries are expected to continue experiencing deteriorating business conditions.

“In the petrochemical sector, prolonged downturns have eroded profitability,” Kwon explained. “Liquidity coverage for short-term borrowings has weakened relative to available cash and operating cash flows.”

Construction continues to face sluggish pre-sale markets and increased regulatory burdens related to safety incidents. The steel industry is grappling with heightened investment requirements for ESG (Environmental, Social, and Governance) compliance and overseas facilities, while secondary batteries face demand concerns following the expiration of US electric vehicle tax credits.

Moody’s: AI Boom to Benefit Data Centers, Power, Telecom, and Semiconductors

Meanwhile, Moody’s expects the AI boom to benefit a range of sectors, including data centers, power, telecom, and semiconductors.

Sean Hwang, Senior Analyst at Moody’s Ratings, said, “Demand for data centers driven by AI innovation will persist for several years. In the Asia-Pacific region alone, data center capacity is expected to double, translating to an annual growth rate of 20%.”

“Significant investments will be required through 2030 for facilities, power generation, and grid expansion,” he added. “This presents opportunities for the power, telecom, and semiconductor sectors.”

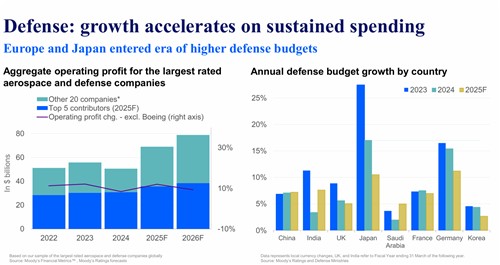

The defense industry is also identified as a mid-to-long-term beneficiary. “South Korea’s defense industry is expected to grow 10–12% annually next year, supported by rising global defense spending,” Hwang said. “Given the limited capacity of European defense firms to absorb all announced investment plans, US and Korean companies are also poised to benefit over the medium to long term.”

joongjp@yna.co.kr

(End)

※Copyright (c) Yonhap Infomax. Unauthorized reproduction and redistribution, as well as AI learning and utilization, are prohibited.

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.