(Seoul=Yonhap Infomax) Hak Seong Kim – SK Square Co. has emerged as a model for addressing the persistent "holding company discount," drawing significant attention from capital markets.

Analysts attribute the company's success to its clear target-setting and effective execution strategies.

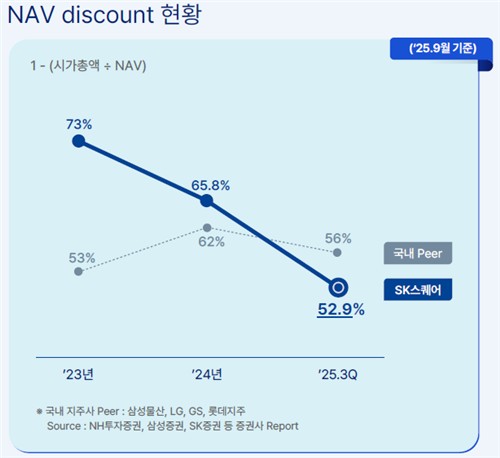

According to SK Square, the company's net asset value (NAV) discount rate fell from 65.8% at the end of last year to 52.9% at the end of the third quarter this year.

Until last year, SK Square's NAV discount rate exceeded the domestic holding company average (62%), but this year it dropped below the average (56%).

The NAV discount rate rises when the market undervalues a company's shares relative to its net asset value. A declining NAV discount rate indicates that the valuation gap is narrowing.

SK Square's improvement is also evident in its price-to-book ratio (PBR), which rose from 0.6x last year to 1.1x at the end of the third quarter, matching the KOSPI 200 average and surpassing the domestic holding company average (0.7x).

These achievements are seen as the result of SK Square's value enhancement ("value-up") initiatives launched last year.

In November last year, SK Square became the first South Korean company to set a NAV discount rate target (below 50% by 2027) and linked it to executive compensation. The company also clearly disclosed its cost of equity (COE) at 13–14% and pledged to achieve a return on equity (ROE) exceeding this level, as well as to reach a PBR of at least 1x by 2027.

Additionally, SK Square announced a concrete plan to buy back and cancel undervalued treasury shares when the NAV discount rate is high, thereby increasing per-share value.

SK Square's value-up plan was well received at the time of its announcement.

The Korea Corporate Governance Forum commented, "It is remarkable that the company recognizes its cost of equity," adding, "The board has established and implemented a capital allocation policy considering the NAV discount rate since last year, and linking this to key performance indicators (KPIs) and executive compensation aligns with global standards."

UK activist fund Palisade Capital, which has engaged with SK Square as a shareholder, also praised the company, saying, "SK Square has demonstrated a strong commitment to capital allocation focused on portfolio optimization and shareholder returns, as well as to creating shareholder value."

Last year, SK Square repurchased and canceled more than 5% of its outstanding shares, and has continued to buy back shares this year.

Buying back shares when the NAV discount rate is high can deliver strong returns to shareholders, with a certainty of returns not guaranteed by investment projects.

Recognizing these achievements, Myung Jin Han, former CEO of SK Square, was promoted to head of the MNO (Mobile Network Operator) CIC (Company-in-Company) at SK Telecom Co. in this year's regular executive reshuffle. Kim Jung Kyu, previously chief secretary to Chairman Chey Tae-won at SK Inc., was appointed as the new CEO of SK Square.

Additionally, the sharp rise in the share price of key subsidiary SK hynix Inc. has contributed to resolving SK Square's undervaluation.

Driven by a global surge in artificial intelligence (AI) investment and a memory chip boom, SK hynix shares have soared 200% this year. SK Square's shares have climbed more than 250%, with investors drawn to the opportunity to buy SK hynix at a discount through SK Square.

On the previous day, SK Square set an even more ambitious target, aiming to reduce its NAV discount rate to below 30% by 2028. Kim Jung Kyu, CEO of SK Square, stated, "We will continue to optimize capital allocation for new investments and shareholder returns based on clear criteria focused on investment profitability."

hskim@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.