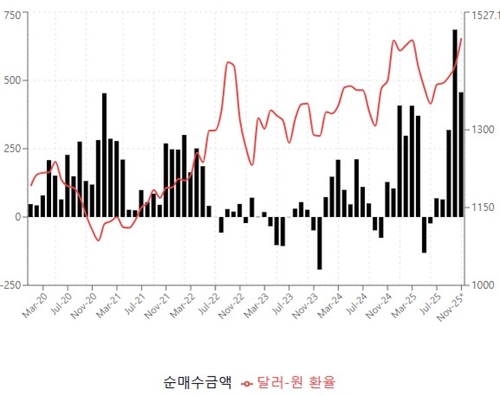

(Seoul=Yonhap Infomax) Seon Mi Jeong, Kyu Sun Lee—South Korea’s foreign exchange authorities have urgently summoned the heads of FX desks at major securities firms, as surging demand from retail investors for U.S. stocks—known locally as “Seohak Ants”—is seen as fueling upward pressure on the won-dollar exchange rate.

With the dollar-won rate threatening to breach the 1,500-won mark, authorities have expanded their outreach beyond the National Pension Service and major exporters to now include securities firms, seeking cooperation to stabilize the currency market.

According to industry sources on the 25th, the Ministry of Economy and Finance, Bank of Korea, and Financial Supervisory Service convened a closed-door meeting on the 21st with FX managers from nine securities firms, including Mirae Asset Securities and Korea Investment & Securities, all members of the Foreign Exchange Market Council. This follows earlier meetings with major exporters and the National Pension Service (see Yonhap Infomax’s November 17 article, “FX Authorities Meet Samsung Electronics, Hyundai Motor, Shipbuilders—Will Dollar Supply Improve?”).

Typically, during periods of sharp currency moves, authorities seek cooperation from large market participants such as major domestic and foreign banks, Samsung Electronics Co., and the National Pension Service. However, with retail investors’ settlement demand for overseas stocks now identified as a key trigger for recent won weakness, the focus has shifted to securities firms.

Data from the Korea Securities Depository show that in October, net purchases of U.S. stocks by Korean investors reached $6.8 billion, with another $4.5 billion recorded through November 21.

“Sell $30, Buy $50—Only $20 Needed”: The 9 a.m. Bottleneck

Authorities reportedly scrutinized the FX settlement practices tied to the “integrated margin” system at securities firms during the meeting.

The integrated margin system allows all assets held in an account—including won, dollars, yen, and pending settlements—to be aggregated as available funds for trading. The core feature is netting transactions based on settlement date, rather than converting currency for each trade.

For securities firms, this maximizes FX efficiency. For example, if Customer A sells $30 and Customer B buys $50, the system nets the transactions so only $20 needs to be purchased, rather than $80 if handled separately. This is similar to how commercial banks settle only the net amount of interbank transfers overnight.

The issue is that to calculate this “final net amount,” a fixed settlement cut-off is needed. Securities firms, therefore, must purchase the required dollars in bulk at the start of the Seoul FX market at 9:00 a.m., based on overnight netting.

Authorities believe these large buy orders at market open create structural demand imbalances, pushing the exchange rate higher.

Authorities Propose MAR, Real-Time FX—Industry Cites Structural Dilemma

During the meeting, authorities suggested using the Market Average Rate (MAR) or expanding real-time FX conversion to disperse demand, rather than concentrating settlements at specific times like market open.

While industry participants acknowledged the authorities’ concerns over increased volatility at certain times, they expressed reservations about practical implementation.

“The MAR may work for dollar-won trades, but it’s difficult to apply to cross-currency transactions, and settlement lags like T+1 pose additional challenges,” said one securities firm official present at the meeting.

Another official noted, “Switching to real-time FX would eliminate netting, potentially passing higher costs to short-term traders and clients. Large conversions during illiquid night hours could also increase risk.”

Industry representatives emphasized that the 9 a.m. FX concentration predates the integrated margin system, tracing back to the era of provisional FX conversion. The impact has only grown as overseas stock investment and integrated margin balances have surged since the COVID-19 pandemic.

They also voiced concerns about the burden of overhauling IT systems. “We understand the authorities’ intent, but with financial system stability a top priority and 24-hour FX trading set to launch next year, immediate system or policy changes would be a significant operational challenge,” said another securities firm official.

Authorities stressed that the review is focused on “financial consumer protection.” They are examining whether mechanical bulk buying by securities firms at market open artificially inflates the exchange rate, passing higher settlement rates onto clients.

“The core of this meeting was to check whether clients are being forced to buy dollars at unnecessarily high rates,” said an FX authority official. “We are concerned that securities firms may be artificially pushing up the rate and applying the higher settlement price to clients, meaning consumers end up paying more than the MAR or posted bank rates.”

smjeong@yna.co.kr

kslee2@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.