(Seoul=Yonhap Infomax) Min Jae Lee – Barclays expects the Bank of Korea to lower its benchmark interest rate at the Monetary Policy Board meeting scheduled for the 27th.

The British investment bank noted that while risks related to the foreign exchange rate and real estate have somewhat eased, concerns are mounting over rising household and corporate loan rates and the potential for increased delinquencies.

“Our baseline scenario assumes a 25bp rate cut at the November policy meeting, followed by a rate hold through 2027,” said Barclays economist Son Beom-gi in an interview with Yonhap Infomax on the 25th.

Son added, “The decision to cut rates at this meeting is likely to be a close call, and we may see two dissenting votes in favor of holding.”

Regarding the three-month forward guidance, Son expects five Monetary Policy Board members to prefer holding the rate at 2.25%. The Bank of Korea’s current base rate stands at 2.50%.

“Given the close call on a rate cut, we also consider an alternative scenario where the Bank holds rates at this meeting and implements an additional cut in the first quarter of next year,” Son said.

Son explained that while the market expects a rate hold due to concerns over the exchange rate and real estate prices, related risks have partially subsided.

“Previously, sharp FX volatility was driven by foreign capital outflows, but now, the main factor is increased overseas investment by domestic investors, so the risk of financial instability from excessive volatility is limited,” Son assessed.

He added, “The exchange rate also plays an automatic stabilizing role, so the Bank of Korea is likely to tolerate some fluctuation as long as it is not excessive.”

On real estate, Son noted, “While Seoul apartment prices have risen 0.2% week-on-week, transaction volumes have dropped by 80–90%, weakening the representativeness of price indicators.”

He continued, “The Bank of Korea appears willing to tolerate some degree of real estate price increase during the economic recovery phase.”

Son further evaluated, “Although overheating risks in the real estate sector remain, recent macroprudential policies have sharply reduced transaction volumes, thereby mitigating the risk of significant overheating.”

He analyzed, “Removing expectations for further rate cuts could keep five-year rates elevated, which would in turn maintain mortgage rates at higher levels and tighten lending conditions.”

Son identified market interest rates as a more critical variable than FX or real estate.

“Market rates have risen significantly due to changing monetary policy expectations and stress in the credit market,” Son said. “This suggests a further increase in delinquency rates for both corporates and households as loan rates rise.”

From the lender’s perspective, “Rising delinquencies, higher funding costs, and losses on existing bonds could weaken credit creation and financial intermediation, increasing short-term economic volatility,” he pointed out.

Son explained, “A base rate cut would lower household and corporate loan rates tied to the one-year reference rate, helping to mitigate the risk of rising delinquencies. This would support a soft landing in sectors requiring restructuring and reduce economic volatility.”

He also noted that with the Bank of Korea unable to be confident in a strong domestic recovery, a hawkish policy shift is unlikely.

In its upcoming revised economic outlook, the Bank of Korea is expected to raise its 2025 and 2026 GDP growth forecasts from 0.9% and 1.6% to 1.0% and 1.8%, respectively, and project 2027 growth at 1.7–1.8%. Inflation forecasts for 2025 and 2026 are estimated at 2.1% and 1.9%.

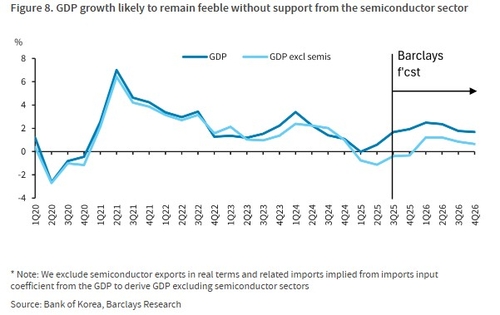

Barclays forecasts South Korea’s GDP growth at 1.1% for this year and 2.1% for next year. Excluding semiconductors, growth is estimated at -0.7% in 2025 and 1.1% in 2026.

*

mjlee@yna.co.kr

(End)

© Yonhap Infomax. All rights reserved. Unauthorized reproduction, redistribution, or AI training/use is prohibited.

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.