(Seoul=Yonhap Infomax) Hyun Woo Roh = A surge in demand from securities firms for new hybrid securities issued by South Korean financial holding companies has drawn market attention.

While final end-users such as pension funds have remained cautious amid a sharp rise in market interest rates, intermediaries have reportedly been actively purchasing these instruments in anticipation of future retail and institutional demand.

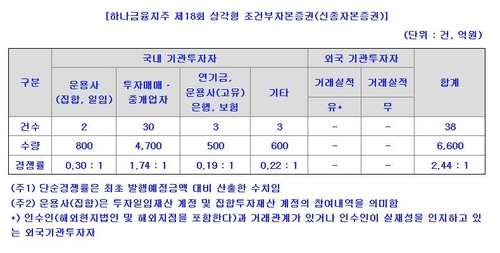

According to the Financial Supervisory Service’s electronic disclosure system on the 25th, securities firms accounted for a significant portion of demand in Hana Financial Group’s recent book-building for its new hybrid securities.

Of the 660 billion won ($505 million) in valid demand, investment dealers and brokers took up 470 billion won ($360 million), representing more than 70% of the total allocation.

Back in August, when Hana Financial Group issued similar hybrid securities, intermediaries accounted for only about 40% of the allocation, highlighting a notable increase in their share.

Hana Financial Group initially planned to issue 270 billion won ($207 million) in hybrid securities, but strong demand led the company to increase the issuance to 400 billion won ($306 million) at a coupon rate of 3.69%.

“With market interest rates surging, end-users have been taking a wait-and-see approach,” said a participant in the bond market. “However, securities firms have been eager to buy, anticipating a lack of new hybrid securities issuance in the near term.”

Hybrid securities issued by financial holding companies are considered relatively stable and offer higher yields, making them attractive to both institutional and retail investors.

Although these are perpetual bonds, they come with a call option after five years.

“There is strong demand from both institutions and individuals for bonds with such maturities and yields,” explained a bond dealer at a securities firm.

Some in the bond market are also watching for the possibility of forward transactions involving credit instruments.

There is speculation that securities firms may have entered into contracts to sell these credit instruments to retirement pension-related funds in a month or two, purchasing them in advance.

Retirement pension funds are typically set up toward the end of the year, a period when credit issuance tends to decline, making it difficult to secure bonds that meet target yields.

If securities firms enter into derivative contracts to purchase credit instruments and later transfer them, they only need to hedge the funding cost for the interim period.

“There is a spike in bond issuance by banks and financial holding companies in November, but almost none in December,” noted another bond market participant. “Forward transactions are being executed to meet the needs of retirement pension providers.”

hwroh3@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.