(Seoul=Yonhap Infomax) Jae Heon Lee – The recent surge in interest rates, triggered by hawkish remarks from Bank of Korea Governor Rhee Chang-yong, is sharply increasing borrowing costs for South Korea’s energy state-owned enterprises. Korea Electric Power Corp. (KEPCO) – the largest player in the domestic short-term bond market – now faces mounting challenges in rolling over trillions of won in maturing debt each month. With the added pressure of a strong US dollar, market participants say close monitoring of volatility is warranted in the near term.

According to Yonhap Infomax’s integrated statistics on commercial paper (CP) and electronic short-term bonds (screen no. 4717) as of the 24th, KEPCO’s outstanding CP and short-term bond balance stood at 13.36 trillion won ($10.2 billion), the highest among domestic issuers. KEPCO’s balance is nearly double that of the second-largest issuer, underscoring its outsized influence on the short-term corporate bond market.

KEPCO’s CP and short-term bonds mature in as little as 25 days and up to nearly 90 days. Even on the same issuance date, the company splits issuances into several hundred billion won tranches to meticulously manage funding needs and repayment schedules. Established under the KEPCO Act, the company enjoys the same credit rating as the South Korean government, serving as a stable source and supplier of funds in the market.

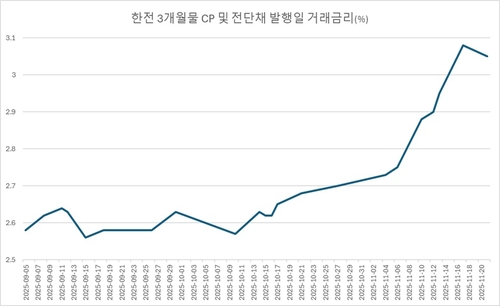

Despite its status as a top-tier institution, KEPCO has been fully exposed to the recent spike in interest rates. Until September, the company’s CP and short-term bond issuance rates hovered in the high 2.5% range, a trend that continued through October.

This month, rates have gradually climbed, with three-month paper surpassing the 3% mark in mid-November after Governor Rhee signaled a potential policy shift in a foreign media interview. As a result, KEPCO is now paying up to 50 basis points more in interest on short-term funding. Having already issued 6 trillion won ($4.6 billion) in November, the company faces tens of billions of won in additional interest costs.

KEPCO faces maturities of around 4 trillion won ($3.1 billion) each in December and January. Given its cash flow structure, it cannot repay all maturing debt outright, making refinancing essential. Sustained rates above 3% could further complicate the company’s funding outlook.

Despite rising global commodity prices, electricity tariffs have not increased, forcing KEPCO to shoulder massive debt on behalf of the public. The company is pursuing aggressive self-help measures to improve its financial health, but market conditions remain beyond its direct control, making responsive funding strategies critical going forward.

“We plan to flexibly adjust the timing and scale of short-term bond issuances in line with market conditions,” a KEPCO official said.

Market participants note that the situation is further complicated by the strong won-dollar exchange rate. “With the US not having ended its rate-cutting cycle, it’s difficult for the Bank of Korea to act preemptively. The mention of a policy pivot has heightened volatility concerns,” said a bond market official. “With both the exchange rate and housing prices elevated, it will be hard to induce lower rates in the near term. The supply and demand dynamics of large institutions like KEPCO will remain a key focus for market participants.”

jhlee2@yna.co.kr

(End)

© Yonhap Infomax. All rights reserved. Unauthorized reproduction, redistribution, or AI training/use prohibited.

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.