(Seoul=Yonhap Infomax) Eun Byul Yun – South Korea Gas Corporation (KOGAS), the state-run gas utility, faces mounting pressure as a significant portion of its short-term debt matures at the end of the year, coinciding with a sharp rise in short-term interest rates and seasonal liquidity tightening in local markets.

According to Yonhap Infomax’s integrated statistics on commercial paper (CP) and electronic short-term bonds (screen no. 4717) as of the 25th, KOGAS’s outstanding short-term debt—including CP and electronic short-term notes—stood at 5.14 trillion won ($3.97 billion).

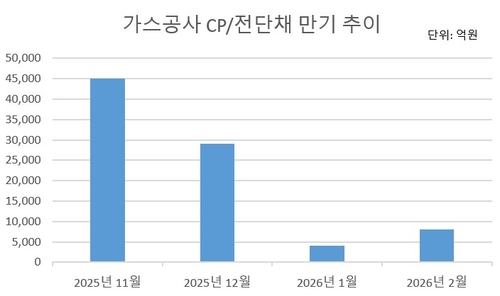

Notably, more than 60% of this—over 3 trillion won ($2.32 billion)—is set to mature by year-end. Yonhap Infomax’s issuer-specific bond maturity statistics (screen no. 4290) show KOGAS’s remaining short-term debt maturing within the year totals 3.18 trillion won ($2.46 billion).

Amid a recalibration of monetary policy expectations, bond yields have surged and credit market sentiment has cooled. The yield on 91-day CP jumped from around 2.7% at the end of last month to 2.96% as of yesterday. Should KOGAS roll over the entire maturing amount at these higher rates, its additional interest burden is estimated to reach several billion won.

Year-end typically brings seasonal liquidity contraction, further complicating refinancing conditions. Over the past five years, short-term rates including CP have consistently risen between October and December.

Recent KOGAS issuance trends also reflect this rate spike. The coupon rate for CP maturing in March 2025, issued on the 19th, was in the 3% range—substantially higher than the 2.6–2.7% range for three-month notes issued in September and October.

However, there are signs of stabilization in both the broader bond market and the short-term funding market. One bond market participant noted, “While sentiment for short-term instruments had been very weak, we’re now seeing some recovery. Still, CP rates backed by time deposits remain elevated and have yet to decline, so further monitoring is needed.”

KOGAS is also gradually reducing its debt burden to improve its financial structure, raising the possibility of cash repayment or alternative funding options. As of Q3 this year, KOGAS’s other borrowings—including CP, electronic short-term notes, and bank loans—fell by about 37% quarter-on-quarter to 8.2041 trillion won ($6.34 billion). In contrast, outstanding bonds, including foreign currency bonds, rose about 3% to 27 trillion won ($20.88 billion) during the same period.

A KOGAS official said regarding year-end CP and short-term note refinancing, “We will assess market conditions and consider a range of funding sources.”

*

ebyun@yna.co.kr

(End)

Copyright (c) Yonhap Infomax. All rights reserved. Unauthorized reproduction or redistribution, as well as AI training and utilization, are strictly prohibited.

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.