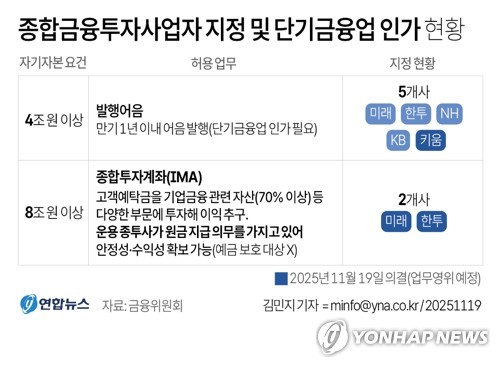

(Seoul=Yonhap Infomax) The era of 'productive finance' is now in full swing. With major securities firms securing licenses for short-term financing and obtaining status as Integrated Investment Account (IMA) operators, South Korea's financial industry has reached another turning point. IMAs are designed as medium-yield products that can compete with deposits while offering principal protection mechanisms. This institutional framework is expected to provide a stable supply of large-scale, long-term capital needed for corporate finance. More than just an expansion of securities firms' business, this marks the advent of the mega-investment bank (IB) model in Korea.

Securities firms have already expanded their role as suppliers of venture capital through issuance of promissory notes and proprietary investments. With the addition of IMAs, a structure is now in place to actively absorb risk assets such as venture capital, small and medium-sized enterprises, and BBB-rated corporate bonds—assets that banks typically avoid. The government's mandate requiring 25% of funds raised via IMAs and promissory notes to be allocated to venture capital by 2028 is in line with this trend. The core of productive finance is to redirect capital away from real estate and toward high-tech industries and venture companies. Securities firms, leveraging agile IB systems and global capital market connectivity, are now poised to lead this shift.

The challenge lies with the banks. Despite their vast financial resources, banks are falling behind in the race for leadership in productive finance. Their lending structures remain heavily collateral-based, with a strong bias toward household and real estate loans. Banks have limited capacity for risk pricing in technology and venture sectors, and lag in developing investment products that can compete with deposits. Structural constraints make it difficult for banks to establish themselves as leaders in productive finance, despite their traditional strength as stable, large-scale capital providers. The sense of crisis is mounting. Major securities firms are rapidly increasing their capital in the IMA era, with some already posting profits that threaten the dominance of banks. The proliferation of deposit-substitute products could even undermine banks' deposit bases. Should banks remain complacent, they risk being marginalized in the evolving landscape of productive finance.

What role, then, should banks play? The answer is 'division of labor.' Banks should focus on providing stable, long-term financing for large-scale facility investments, while securities firms concentrate on venture, startup, and risk asset investments. Take the semiconductor industry as an example: the construction of multi-trillion-won foundry plants requires long-term bank loans and policy finance, whereas next-generation semiconductor design and materials companies are better served by securities firms' venture capital and IPO or mezzanine investments. Only when banks and securities firms collaborate can a virtuous cycle of productive finance be achieved.

The government's push for productive finance is not just about increasing the volume of capital supplied, but about changing the quality and direction of capital flows. Experts advise that banks should introduce structures that allow for non-bank-type risks and establish industry-specific credit assessment systems. Joint participation with securities firms in Business Development Companies (BDCs) or National Growth Funds to expand long-term capital pools is also necessary. Developing deposit-substitute investment accounts to attract long-term funds is another required strategy.

Ultimately, the future of productive finance hinges on the 'division of leadership' between banks and securities firms. When banks provide stability and securities firms demonstrate agility, South Korea's financial sector can move beyond simple capital intermediation to become a catalyst for industrial growth. If the IMA era opens new doors for securities firms, it signals a crisis—and a new challenge—for banks. The scenario of division of labor between securities firms aspiring to become the 'Goldman Sachs of Korea' and banks as stable capital providers may well become the ideal model for productive finance. (Financial News Editor)

chhan@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.