(Seoul=Yonhap Infomax) Seon Mi Jeong—The dollar-won exchange rate opened slightly lower on Tuesday, as expectations for a US Federal Reserve rate cut in December continued to weigh on the greenback.

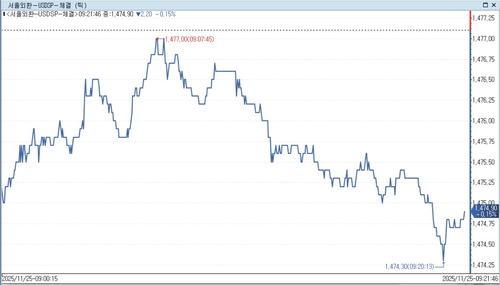

As of 09:22 KST on the 25th in the Seoul foreign exchange market, the dollar-won rate was trading at 1,474.90 won, down 2.20 won from the previous session.

The pair opened at 1,475.20 won, a decline of 1.90 won from the previous day.

Market sentiment was shaped by recent dovish signals from US Federal Reserve officials. Following New York Fed President John Williams last week, overnight Federal Reserve Governor Christopher Waller also voiced support for a December rate cut. San Francisco Fed President Mary Daly added to the momentum, citing the risk of a sharp deterioration in the US labor market as a reason to back a rate reduction.

Meanwhile, South Korea’s Ministry of Economy and Finance, the Bank of Korea, and other foreign exchange authorities announced the formation of a four-party consultative body with the Ministry of Health and Welfare and the National Pension Service to stabilize the FX market. Authorities remain vigilant, with market participants speculating that measures could include expanded currency swap lines with the Bank of Korea or increased FX hedging by the National Pension Service.

In other developments, former US President Donald Trump said he had a “good phone call” with Chinese President Xi Jinping and plans to visit China in April next year.

South Korea’s benchmark KOSPI index, which closed slightly lower the previous day, rebounded by around 1.7% on the back of gains in the New York stock market.

The US dollar index hovered near 100.2 in early trading, showing a mild downward bias.

“While US equities and the KOSPI are rising, the downside for the dollar-won remains limited,” said a foreign exchange dealer at a local bank. “With the Bank of Korea’s Monetary Policy Board meeting scheduled this week and no major data releases expected after the US government shutdown, it’s difficult to see a clear downward trend.”

He added, “Cautious sentiment is likely to persist, and with long positions not fully unwound, there is still more room to the upside.”

At the same time, the dollar-yen rate was quoted at 156.930 yen, up 0.107 yen from the New York session, while the euro-dollar rate was at 1.15211 dollars, down 0.00010 dollars.

The yen-won cross rate stood at 939.55 won per 100 yen, and the yuan-won rate was at 207.57 won.

The KOSPI rose 1.61%, with foreign investors net buying approximately 55.3 billion won ($41.5 million).

Offshore dollar-yuan (CNH) was quoted at 7.1046 yuan.

smjeong@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.