(Seoul=Yonhap Infomax) Sun Young Jung – As the dollar-won exchange rate approaches the 1,500-won threshold, monthly volatility has surged, prompting speculation in the foreign exchange market that the next major resistance level, or "big figure," could rise to 1,600 won.

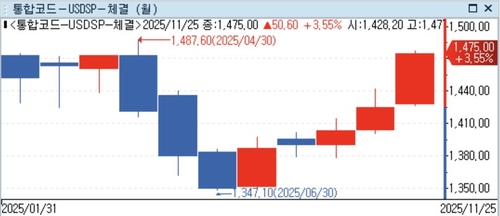

According to Yonhap Infomax's daily trading summary (screen number 2150) on the 25th, the dollar-won exchange rate's monthly volatility in November increased by 3.55% compared to the end of the previous month.

This marks a larger swing than the 3.52% rise seen in April this year and represents the highest monthly volatility for 2024.

While the exchange rate's upward momentum has somewhat eased as authorities intervened around the 1,470-won level, the market remains on alert.

South Korea's foreign exchange authorities have focused on diversifying dollar demand and securing dollar supply to stabilize the market.

Key market participants—including the National Pension Service, exporters, and securities firms—have held a series of meetings with authorities to discuss stabilization measures for the exchange rate.

If the dollar-won rate breaches the 1,500-won mark, the upper bound for the next big figure is expected to shift to 1,600 won.

While significant resistance is likely between 1,500 and 1,600 won, a break above these levels could prompt market participants to anticipate further upside.

Some in the market are leaving open the possibility that the exchange rate could enter the 1,500-won range and approach the 1,600-won big figure.

Analysts warn that unless dollar demand is diversified over the medium to long term, upward pressure on the dollar-won rate will be difficult to alleviate.

One foreign exchange market participant said, "The only factors that could trigger a significant weakening of the global dollar would be a major loss of confidence in the US Federal Reserve or a sharp downturn in US capital markets. Barring these, the dollar is unlikely to weaken substantially from current levels." He added, "While the 1,500-won level may hold through the end of this year, the direction seems more likely toward 1,600 won than below 1,400 won."

He continued, "The National Pension Service may adjust its pace, but funds swapped above 1,400 won this year would ultimately have to be repurchased below that level. Fundamentally, the NPS remains a source of dollar demand, making it difficult to ease medium- to long-term upward pressure."

Economic forecasting agencies such as Economy Forecast Agency (EFA), which model long-term projections for oil prices, exchange rates, and interest rates, expect the dollar-won rate to reach the 1,500-won range by 2026.

Notably, the April forecast was set as high as 1,592.00 won, and the 2027 monthly outlook included a projection of 1,604 won.

However, such forecasts may be skewed higher due to the difficulty of factoring in variables like government intervention.

Despite strong dollar demand in the Seoul FX market, the consensus remains that the dollar-won rate will trend in the 1,400-won range next year.

In its recently released 2026 annual FX outlook, ING Bank stated, "In 2026, GDP growth is expected to recover to 2.0%, supported by a robust semiconductor cycle and exports. The Fed's 75bp rate cut is likely to outpace the Bank of Korea's 25bp cut, and domestic political stability will help reduce exchange rate volatility." The bank projected the dollar-won rate to find equilibrium near the 1,400-won level.

syjung@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.