(Seoul=Yonhap Infomax) Ji Yeon Kim—The USD/KRW exchange rate fell to the low 1,470 won range, tracking a weaker US dollar.

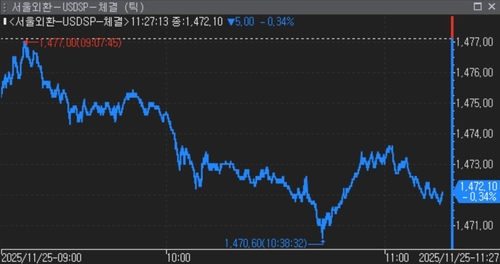

As of 11:27 AM KST on the 25th in the Seoul foreign exchange market, the dollar-won rate was trading at 1,472.10 won, down 5.00 won from the previous session.

The session opened at 1,475.20 won, down 1.90 won from the previous day. Early in the session, the rate climbed to 1,477.00 won, threatening the previous day's high, but reversed course as market participants perceived the level as a peak.

Comments from US Federal Reserve officials supporting rate cuts strengthened expectations for a December policy easing, sending the dollar lower in Asian trading. The dollar-won rate came under further downward pressure as Asian currencies such as the yen, yuan, and Taiwan dollar broadly strengthened.

Additionally, news that South Korea's foreign exchange authorities, together with the Ministry of Health and Welfare and the National Pension Service, plan to establish a four-party consultative body to stabilize the FX market heightened vigilance over potential intervention.

As a result, the exchange rate briefly touched a session low of 1,470.60 won before finding support.

On the political front, Song Eon-seok, floor leader of the ruling People Power Party, criticized the move to mobilize the National Pension Service for FX stabilization, saying, "Using the National Pension Fund to defend the won shifts the burden of the government's FX market instability onto the retirement savings of the entire population." Kim Do-eup, the party's policy chief, added, "Experts warn that deploying the National Pension Service as a relief pitcher for currency defense could undermine the fund's profitability and stability. The National Assembly's Strategy and Finance Committee, chaired by the People Power Party, will pursue an emergency inquiry into high exchange rate countermeasures."

Meanwhile, according to foreign media, US President Donald Trump and Japanese Prime Minister Sanae Takaichi held a phone call to discuss US-China relations and strengthening the US-Japan alliance.

Later tonight, key US economic indicators will be released, including the September Producer Price Index (PPI), ADP weekly employment change, November Conference Board (CB) Consumer Confidence Index, and the November Richmond Fed Manufacturing and Services Indexes.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate at 7.0826 yuan, an appreciation of 0.03% from the previous session.

The US Dollar Index fell to the 100.15 level.

Foreign investors net sold over 16,000 contracts of dollar futures in the currency futures market.

Afternoon Outlook

FX dealers expect the dollar-won rate to continue searching for direction within a downward trend in the afternoon session.

An FX dealer at a local bank said, "The exchange rate appears to be following the dollar index lower. With the domestic stock market strong and foreign investors' net stock selling not significant, the level has declined."

He added, "There is a sense of caution over possible intervention at higher levels, so the rate is unlikely to rise above the 1,480 won mark."

A dealer at a securities firm noted, "The rate reached the 1,477 won level early in the session, but as the perception of a peak set in, some selling emerged. Foreign investors have sold up to 16,000 contracts of dollar futures, prompting an adjustment."

He added, "The current level is closely watched by the authorities, making it a tricky zone for position-taking."

Intraday Trends

The dollar-won rate opened down 1.90 won, tracking a decline in the New York non-deliverable forward (NDF) one-month contract.

The intraday high was 1,477.00 won, and the low was 1,470.60 won, with a trading range of 6.40 won.

Foreign investors net sold 42.1 billion won ($32.5 million) worth of stocks on the KOSPI and net bought 40.1 billion won ($31.0 million) on the KOSDAQ.

According to Yonhap Infomax's estimated trading volume (screen no. 2139), as of this time, turnover was approximately $4.5 billion.

The dollar-yen rate was 156.620 yen, down 0.203 yen from the New York session, while the euro-dollar rate was 1.15266, up 0.00039.

The yen-won cross rate was 939.73 won per 100 yen, and the yuan-won rate was 207.52 won.

The offshore dollar-yuan (CNH) rate fell to 7.0970 yuan.

jykim2@yna.co.kr

(End)

Exchange Rate Data Table

| Date | Exchange Rate (CNY/USD) |

|---|---|

| 2025-11-25 | 7.0826 |

Trend Analysis: The USD/KRW rate declined sharply, pressured by a weaker dollar and expectations of US rate cuts. Authorities' intervention concerns and strong Asian currencies contributed to the downward move. The PBOC set the yuan stronger, and foreign investors increased dollar futures selling, signaling further downside risk for the won.

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.