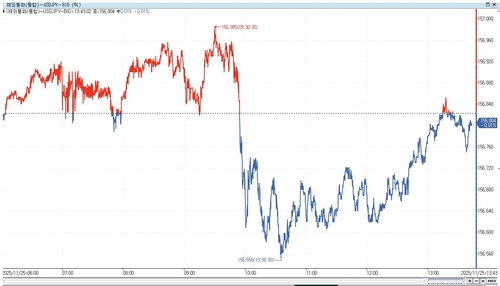

(Seoul=Yonhap Infomax) Min Jae Lee – The dollar-yen exchange rate traded in a narrow range in Tokyo on the 25th, as concerns over Japan’s fiscal health under the Takaiichi administration’s expansionary policies were counterbalanced by speculation of official intervention in the foreign exchange market.

According to Yonhap Infomax (screen number 6411), as of 13:43 local time, the dollar-yen was trading at 156.804 yen, down 0.01% from the previous session.

The dollar-yen pair remained mostly higher in early morning trading, though gains were limited.

On the previous trading day, the Takaiichi Cabinet approved a comprehensive economic package worth 21.3 trillion yen. Market participants expressed concerns that the administration’s aggressive fiscal stance could worsen Japan’s fiscal position, prompting yen selling and dollar buying.

However, the dollar-yen quickly gave up its earlier gains and reversed course, at one point falling 0.17% to 156.556 yen.

Expectations that the US Federal Reserve (Fed) could cut rates in December fueled yen buying and dollar selling. Last week, New York Fed President John Williams significantly raised market expectations for a December rate cut, and overnight, Fed Governor Christopher Waller joined in, stating on the 24th (local time), “My main concern regarding our dual mandate (price stability and full employment) is the labor market,” adding, “I support a rate cut at the next meeting.”

Speculation over possible intervention by Japanese monetary authorities also lent support to the yen. On the 22nd, Japanese Finance Minister Satsuki Katayama signaled the possibility of market intervention, stating, “We will take decisive action against rapid yen depreciation.”

Following a cabinet meeting on the morning of the 25th, Economic Revitalization Minister Minoru Kiuchi said at a press conference, “We are closely monitoring foreign exchange market trends, including speculative movements, with a high sense of urgency.”

Nevertheless, volatility in the dollar-yen remained limited, with the pair retracing most of its losses in afternoon trading.

Meanwhile, the dollar index, which measures the greenback against six major currencies, was up 0.05% at 100.232.

The euro-yen was down 0.07% at 180.56 yen, while the euro-dollar slipped 0.06% to 1.15150 dollars.

mjlee@yna.co.kr

(End)

Exchange Rate Data Table

| Date | Exchange Rate (USD/JPY) |

|---|---|

| 2025-11-25 | 156.8040 |

| 2025-11-25 (Low) | 156.5560 |

Trend Analysis: The dollar-yen exchange rate remained range-bound amid conflicting pressures from Japan’s fiscal expansion and intervention speculation. The pair briefly dipped to 156.5560 yen before recovering, reflecting heightened sensitivity to both domestic fiscal policy and US monetary policy expectations.

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.