(Seoul=Yonhap Infomax) Young Tae Seo – The vast majority of bond market participants anticipate that the Bank of Korea will keep its policy rate unchanged this month.

According to the Korea Financial Investment Association (KOFIA) on the 25th, 96% of respondents to the Benchmark Market Sentiment Index (BMSI) survey expect the Monetary Policy Board to maintain the base rate at its November meeting. This marks an increase from 85% in the previous survey.

A KOFIA official stated, “Expectations for a rate hold at the November meeting have risen compared to the previous survey, driven by upward revisions to GDP forecasts and the prolonged period of a strong U.S. dollar.”

The BMSI survey targets professionals in the bond market, with 100 participants from 47 institutions.

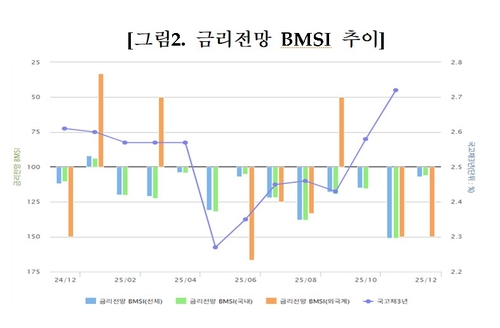

Market sentiment regarding interest rates has deteriorated. The interest rate outlook BMSI fell to 107.0 from 151.0 in the previous month. As the likelihood of both the Bank of Korea and the U.S. Federal Reserve holding rates increased, domestic short-term funding and government bond yields rose sharply, and more respondents now expect a rate hike in December.

Inflation-related bond market sentiment improved compared to the previous month, with the inflation BMSI rising to 92.0 from 85.0.

A KOFIA official noted, “While responses expecting higher inflation still outnumber those expecting a decline—due to rebounding international oil prices and a strong dollar—the share of respondents anticipating lower inflation has increased slightly from last month.”

Exchange rate sentiment in the bond market also improved from the previous month. KOFIA analysis indicates that as the won-dollar rate approached a psychological resistance level, demand for FX hedging increased, leading to a rise in respondents expecting a lower exchange rate in December.

The composite BMSI fell by 8.3 points to 103.2 from 111.5 in the previous month.

A KOFIA official added, “Expectations for a rate cut have receded, and with market rates rising rapidly, bond market sentiment for December 2025 has worsened compared to the previous month.”

ytseo@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.