(Seoul=Yonhap Infomax) Ji Yeon Kim – On the 25th, Japanese equities ended mixed as profit-taking offset overnight gains on Wall Street.

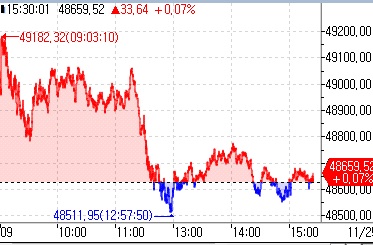

According to the Yonhap Infomax Global Stock Index (6511), the Nikkei 225 closed up 33.64 points, or 0.07%, at 48,659.52. The TOPIX index finished down 6.84 points, or 0.21%, at 3,290.89.

After a holiday closure in the previous session, Japanese markets opened higher, buoyed by the strong performance of U.S. equities overnight, with the Nikkei briefly approaching the 50,000 mark.

However, gains narrowed around midday as foreign investors engaged in profit-taking, particularly through Nikkei futures selling, erasing morning advances and leaving the market to fluctuate near the flatline in the afternoon session.

SoftBank Group Corp. (TSE:9984) tumbled more than 10%, exerting significant downward pressure on the index.

The sell-off was attributed to mounting concerns over intensifying competition with OpenAI—backed by SoftBank—after Google’s next-generation AI model, Gemini 3, received strong market reviews.

Other major names in the communications and technology sectors, including KDDI Corp. (TSE:9433) and Sony Group Corp. (TSE:6758), also declined more than 2%.

Bond yields rose.

With Japanese financial markets closed the previous day, comments over the weekend from Kazuyuki Masu, Policy Board Member at the Bank of Japan (BOJ), suggesting an early rate hike, added upward pressure to yields.

Masu stated, “I cannot say which month, but in terms of distance, we are close,” indicating that a BOJ rate hike decision is “approaching.”

According to Yonhap Infomax Overseas Bond Rates (screen number 6531), the yield on 10-year Japanese government bonds stood at 1.8024% at the close, up 1.48 basis points from the previous session.

At the same time, the 30-year ultra-long bond yield rose 0.58 basis points to 3.3344%, while the 2-year yield climbed 1.00 basis point to 0.9694%.

Amid heightened market volatility, investors remained cautious, with concerns emerging over potentially weak demand at the 40-year government bond auction scheduled for the 26th.

The dollar-yen exchange rate was quoted at 156.70 yen, down 0.07% from the previous session.

jykim@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.