(Seoul=Yonhap Infomax) Yoon Woo Shin – The dollar-won exchange rate closed lower on Tuesday, pressured by heightened vigilance from South Korean foreign exchange authorities and increased FX sales from exporters.

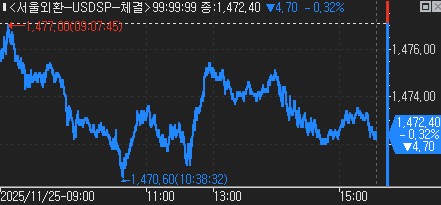

At 15:30 local time, the dollar-won ended regular trading at 1,472.40 won, down 4.70 won from the previous session, marking its first decline in seven trading days.

The pair opened at 1,475.20 won, 1.90 won lower than the previous close, briefly moved sideways, then extended losses throughout the session. The intraday low was 1,470.60 won, before stabilizing and closing slightly higher.

Market participants cited strong resistance near the 1,480 won level and increased caution from authorities as key factors exerting downward pressure on the exchange rate.

On Monday, the Ministry of Economy and Finance, Bank of Korea, Ministry of Health and Welfare, and National Pension Service convened their first four-party meeting to discuss measures for stabilizing the FX market. The formalization of cooperation between FX authorities and the National Pension Service has fueled expectations for extended and expanded currency swap lines and enhanced FX hedging, limiting upside attempts in the dollar-won.

Additionally, the return of exporter FX conversion—rare in recent sessions—accelerated the decline. Foreign investors also shifted to net buying of local equities after three sessions of selling, further supporting the won.

Foreigners, who had offloaded 3.6 trillion won ($2.7 billion) of stocks over the previous two sessions, purchased over 100 billion won ($75 million) on Tuesday. While the buying was not particularly strong, foreign inflows amid a rising KOSPI index contributed to improved risk appetite.

The dollar index fluctuated in the low 100s, while the dollar-yen rate eased slightly to the 156 yen range, reinforcing the dollar-won's reversal.

However, persistent long positioning and steady demand for FX settlements and overseas investment provided support near the 1,470 won level.

Deputy Prime Minister and Minister of Economy and Finance Koo Yun-cheol is scheduled to hold an emergency press briefing on November 26 to address the FX market and exchange rate developments.

Several key US economic indicators are due overnight, including ADP's weekly private employment estimate, September retail sales, producer price index (PPI) for the same month, the Conference Board's November consumer confidence index, October pending home sales, and the September Case-Shiller home price index.

In currency futures, foreign investors were net sellers of approximately 7,000 dollar contracts.

The People's Bank of China set the yuan stronger, with the dollar-yuan reference rate fixed at 7.0826 yuan, down 0.0021 yuan (0.03%) from the previous session.

Outlook for Next Trading Day

FX dealers remain cautious, with an upward bias but limited room for further gains. A bank dealer commented, "Long sentiment persists, but there is reluctance to bet on further appreciation," citing ongoing news related to the National Pension Service. "Upside potential appears limited in the mid-to-high 1,470 won range," the dealer added.

A securities firm dealer noted, "While the overall tone is upward, authorities' vigilance is capping the upside. The market lacks clear direction."

Intraday Market Trends

The dollar-won opened at 1,475.20 won, 1.90 won lower, tracking declines in New York's non-deliverable forward (NDF) one-month contracts. The intraday high was 1,477.00 won, and the low was 1,470.60 won, with a trading range of 6.40 won.

The market average rate (MAR) is expected to be posted at 1,473.50 won.

Spot FX trading volume, combining Seoul Money Brokerage Services and Korea Money Brokerage Corp., totaled $9.012 billion.

South Korea's benchmark KOSPI index rose 0.30% to close at 3,857.78, while the KOSDAQ slipped 0.05% to 856.03.

Foreign investors were net buyers of 115.4 billion won ($86 million) in KOSPI stocks and 98.8 billion won ($74 million) in KOSDAQ shares.

At the close of the Seoul FX market, the dollar-yen stood at 156.738 yen, and the yen-won cross rate was 939.57 won per 100 yen. The euro-dollar rate was 1.15190, and the dollar index was 100.200. The offshore dollar-yuan (CNH) rate was 7.0953 yuan. The yuan-won direct rate closed at 207.45 won per yuan, with an intraday low of 207.33 won and a high of 208.00 won. Combined trading volume at Korea Money Brokerage Corp. and Seoul Money Brokerage Services was 8.574 billion yuan.

*

ywshin@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.