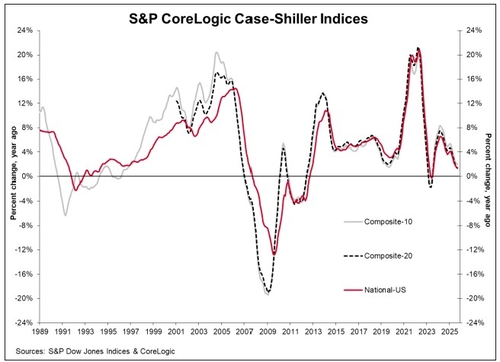

(Seoul=Yonhap Infomax) Won Jung Yoon—The annual growth rate of US home prices in September slowed slightly from August, marking the lowest level since 2023.

According to S&P Dow Jones Indices on the 25th (local time), the S&P CoreLogic Case-Shiller National Home Price Index rose 1.3% year-on-year in September. This is 0.1 percentage point lower than the 1.4% increase recorded in August.

For the fourth consecutive month, inflation has outpaced the growth in home prices. In particular, the gap between the Consumer Price Index (CPI) and the home price growth rate widened to 1.7 percentage points in September, the largest since June.

The annual price increases for the 10-city and 20-city composite indices were 2.0% and 1.4%, respectively, both down from August’s 2.1% and 1.6%—a decrease of 0.1 and 0.2 percentage points, respectively.

On a non-seasonally adjusted basis, the national index fell 0.3% from the previous month, while both the 10-city and 20-city indices declined 0.5% each.

By city, Chicago posted the highest annual increase at 5.5%, followed by New York (5.2%) and Boston (4.1%). In contrast, Tampa saw a 4.1% decline.

Nicholas Godek, Head of Fixed Income and Commodities at S&P, commented, “In context, we are seeing the lowest annual price growth since 2023, when the market was absorbing the initial shock of the Federal Reserve’s aggressive rate hike cycle.”

He added, “Unlike the rapid rebound during that period, current headwinds are more persistent. Mortgage rates remain stubbornly high, and affordability has dropped to the lowest levels in decades, pushing the market toward a new equilibrium of minimal price gains—or even declines in some regions.”

jwyoon2@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.