(New York=Yonhap Infomax) Jin Woo Choi – The US dollar declined in value.

Expectations of a potential peace agreement between Russia and Ukraine led to a drop in oil prices, easing inflation concerns and putting downward pressure on the dollar.

Weaker-than-expected ADP private employment data and retail sales figures also weighed negatively on the greenback.

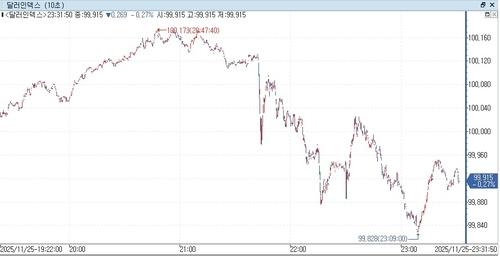

According to Yonhap Infomax (screen number 6411), as of 09:22 AM Eastern Time on the 25th, the US Dollar Index (DXY), which measures the dollar against six major currencies, stood at 99.941, down 0.243 points (0.243%) from the previous close of 100.184.

The dollar came under pressure in New York trading on the possibility of a peace agreement between Russia and Ukraine. The sequence was: falling oil prices → easing inflation fears → lower US Treasury yields → weaker dollar (stronger euro).

US broadcaster ABC reported that "the Ukrainian delegation has agreed with the US on the terms of a potential peace agreement."

A US official told ABC, "Ukraine has agreed to the peace deal," adding, "There are some details to be finalized, but they have agreed to the peace agreement."

Following these reports, January West Texas Intermediate (WTI) crude futures on the New York Mercantile Exchange plunged to the $57 range during New York trading.

Key economic indicators also contributed to the dollar's weakness.

According to private employment data provider ADP, for the four weeks ending on the 8th of this month, US private employment fell by an average of 13,500 per week.

US retail sales for September, seasonally adjusted, totaled $733.3 billion, up 0.2% from the previous month but below the forecast of +0.4%.

The September Producer Price Index (PPI) rose 0.3% month-on-month, in line with market expectations.

The dollar index fell as low as 99.828 intraday, in tandem with declining US Treasury yields.

Francesco Pesole, FX strategist at ING, cautioned, "Year-end rebalancing flows ahead of Thanksgiving may be limiting further dollar weakness."

He added, "Unless the market reprices for a more hawkish Fed, the dollar appears too strong relative to short-term rate differentials, and significant downside risks remain."

The euro-dollar exchange rate rose 0.00315 (0.273%) to $1.15538 from the previous session.

The euro-dollar rate climbed as high as $1.15690 intraday on hopes for a Russia-Ukraine ceasefire.

The pound-dollar rate increased 0.00469 (0.358%) to $1.31553.

The dollar-yen rate fell 0.563 (0.359%) to 156.269 yen.

Pesole noted, "Reduced liquidity during Thanksgiving could provide a favorable environment for Bank of Japan (BOJ) intervention," adding, "Intervention is ideal after a market-driven adjustment."

He also said, "US data could trigger such an adjustment, but today is unlikely to be that day."

The offshore dollar-yuan (CNH) rate fell 0.0217 (0.305%) to 7.0830 yuan from the previous session.

jwchoi@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.