(Seoul=Yonhap Infomax) Sung Jin Kim – Demand at the latest US 5-year Treasury auction was subdued, resulting in a higher-than-expected yield.

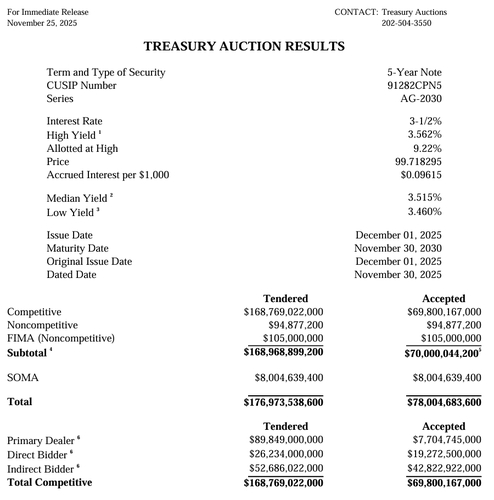

The US Department of the Treasury announced on the 25th (local time) that the yield for the $70 billion 5-year Treasury note auction was set at 3.562%. This marks a decline of 6.3 basis points from last month's auction yield of 3.625%, reaching the lowest level since September last year.

The bid-to-cover ratio stood at 2.41, up from 2.38 in the previous month and above the six-month average of 2.36.

The awarded yield was 0.5 basis points higher than the when-issued trading yield, indicating the result exceeded market expectations.

Indirect bidding, a proxy for foreign investor demand, fell by 5.4 percentage points to 61.4% compared to the previous month. Direct bidding increased from 23.9% to 27.6% over the same period.

The share of unsold securities absorbed by primary dealers rose by 1.7 percentage points to 11.0%.

In the secondary market, the 5-year Treasury yield briefly dipped following the auction results released shortly after 13:00 in New York, but quickly rebounded to levels seen just before the auction.

Earlier, US Treasury yields faced downward pressure after foreign media reported that Kevin Hassett, former economic adviser to President Donald Trump and current White House National Economic Council (NEC) member, was being considered as a leading candidate for the next Federal Reserve (Fed) chair.

sjkim@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.