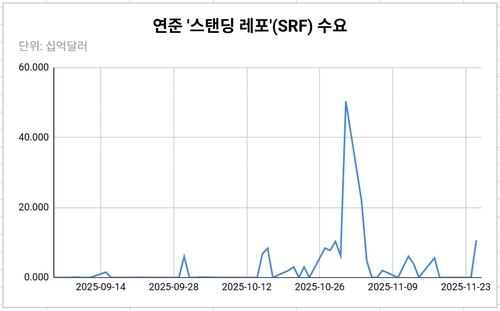

(Seoul=Yonhap Infomax) Sung Jin Kim—Demand for the Federal Reserve's Standing Repo Facility (SRF), a key tool for supplying short-term liquidity, surged to its highest level since the start of the month.

According to the Federal Reserve Bank of New York on the 25th (local time), the morning SRF auction attracted $10.06 billion in demand. While there was no demand in the afternoon session, the total daily figure marked the highest since the first trading day of the month on the 3rd, when demand reached $22 billion.

SRF demand had been negligible—either absent or limited to just a few million dollars—since the 18th. This was largely attributed to an improvement in liquidity conditions as funds from U.S. government-sponsored enterprises (GSEs) entered the money market.

GSEs such as Fannie Mae and Freddie Mac collect principal and interest payments from mortgage borrowers and distribute them to mortgage-backed securities (MBS) investors. These funds typically flow into the money market around the 17th or 18th of each month, remain for about a week, and then exit the system.

Historically, liquidity pressures have re-emerged once GSE funds leave the market. As month-end approaches, these pressures are likely to intensify.

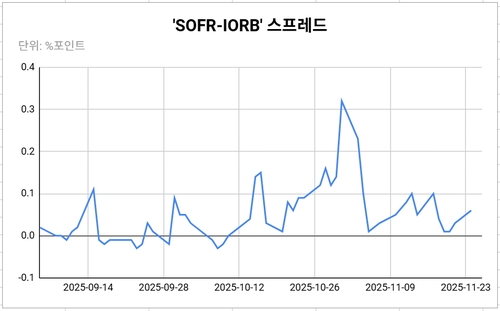

The Secured Overnight Financing Rate (SOFR), a key benchmark for the U.S. money market, has been trending higher since last weekend.

According to separate data from the New York Fed, SOFR stood at 3.96% as of the latest reading on the 24th, up 3 basis points from the previous day. After dipping to 3.91% on the 20th, SOFR has since climbed by 5 basis points.

SOFR has consistently remained above the Interest on Reserve Balances (IORB)—currently at 3.90%—which serves as the effective upper bound of the federal funds rate (FFR) target range, since the 14th of last month. The SOFR-IORB spread has widened to 6 basis points.

sjkim@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.