(Seoul=Yonhap Infomax) Sung Jin Kim – U.S. Treasury prices climbed for a fourth consecutive session, led by strength in shorter maturities, as a series of disappointing economic indicators and reports of a 'Trump loyalist' emerging as a leading candidate for the next Federal Reserve chair fueled market moves.

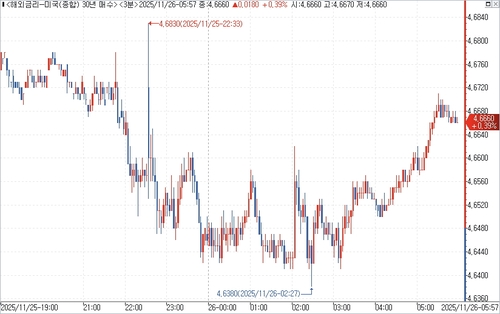

According to Yonhap Infomax’s overseas rates screen (screen no. 6532), as of 15:00 U.S. Eastern Time on the 25th, the yield on the benchmark 10-year Treasury note stood at 4.0020%, down 3.50 basis points from the previous session. The policy-sensitive 2-year yield fell 4.60 basis points to 3.4590%, while the 30-year yield dropped 1.90 basis points to 4.6580%. The yield curve steepened slightly, with the 10-year/2-year spread widening from 53.20bp to 54.30bp. Treasury yields move inversely to prices.

Yields, which had been rangebound, began to decline as the New York session absorbed a raft of weaker-than-expected U.S. economic data. Weekly private employment figures continued to contract, and other indicators such as retail sales and consumer confidence also disappointed.

According to ADP, a private payrolls provider, preliminary U.S. private employment fell by an average of 13,500 per week over the four weeks ending November 8, marking a steeper decline than the previous week (-7,500) and extending a three-week streak of negative readings. Nela Richardson, chief economist at ADP, noted, “As we enter the Thanksgiving holiday period, questions remain about consumer purchasing power, which could delay or reduce job creation.”

Subsequent data from the U.S. Commerce Department showed September retail sales rose just 0.2% month-on-month, slowing from August’s 0.6% gain and missing market expectations of a 0.4% increase. Core retail sales (the control group), which exclude volatile items such as autos, gasoline, building materials, and food services and are used in GDP’s PCE calculation, fell 0.1% from the previous month, marking the first decline since April.

The U.S. Department of Labor reported that the September Producer Price Index (PPI) rose 0.3% month-on-month, in line with market expectations. However, core PPI, which excludes food and energy, rose just 0.1%, below the consensus forecast of 0.2%.

The Conference Board’s November Consumer Confidence Index fell 6.8 points from the previous month to 88.7, the lowest since April (85.7) and below the market forecast of 93.5. Ben Ayers, senior economist at Nationwide, commented, “Despite the deterioration in the survey, spending has held up throughout 2025, but with inflation and labor market concerns, many consumers may be reaching their limits, at least in the short term.”

Midday, foreign media reported that Kevin Hassett, chairman of the White House National Economic Council (NEC) and a key economic adviser to former President Donald Trump, is being considered as a leading candidate for the next Fed chair. Hassett, known for his loyalty to Trump and previously chairman of the Council of Economic Advisers (CEA) during Trump’s first term, has been regarded as one of the most dovish potential Fed chair nominees due to his alignment with Trump’s economic policies and criticism of the Fed.

Following the report, Treasury yields, particularly in the 2-year sector, extended their declines. The 10-year yield briefly fell to 3.9870%, dipping below the 4.0% threshold for the first time since October 29.

However, as risk appetite strengthened in the latter part of the session on news of Hassett’s candidacy, long-term yields pared some losses, with the 10-year yield edging back above 4.0%.

The afternoon’s 5-year Treasury auction saw tepid demand, with the yield set at 3.562%, down 6.3bp from the previous month’s auction (3.625%) and the lowest since September last year. The bid-to-cover ratio rose to 2.41 from 2.38 previously, exceeding the six-month average of 2.36. The auction yield was 0.5bp above the when-issued yield, indicating weaker-than-expected demand.

According to CME FedWatch, as of 15:46 New York time, the federal funds rate futures market priced in an 82.7% probability of a 25bp rate cut by the Fed in December, with only a 17.3% chance of rates remaining unchanged.

sjkim@yna.co.kr

(End)

© Yonhap Infomax. All rights reserved. Unauthorized reproduction and redistribution, as well as AI training and utilization, are prohibited.

Note: U.S. Treasury market quotes in this article are as of 15:00 local time and may differ from closing prices. For official New York bond closing prices, refer to the '[U.S. Treasury Yield Electronic Closing]' article published at 07:30 AM.

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.