(Seoul=Yonhap Infomax) Sung Jin Kim—South Korean treasury futures advanced in overnight trading, buoyed by speculation that a strongly dovish candidate may be appointed as the next chair of the US Federal Reserve (Fed).

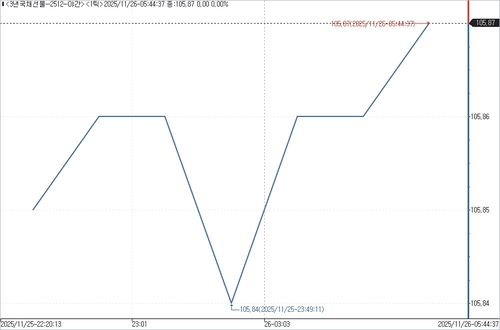

According to the Seoul bond market on the 26th, the 3-year treasury futures contract closed at 105.87 in overnight trading, up 4 ticks from the previous day’s regular session close. Foreign investors were net buyers of 34 contracts, while individuals were net sellers of 34 contracts.

The 10-year treasury futures contract ended 7 ticks higher at 114.50. Foreign investors recorded a net sale of 1 contract, while individuals were net buyers of 1 contract.

Trading volume for the 3-year contract dropped sharply to 66 contracts from 129 in the previous session. The 10-year contract saw a slight increase in volume, rising to 7 contracts from 6.

As of 06:24 KST, US Treasury yields were trending lower, particularly in short-term maturities. The yield on the 10-year US Treasury note fell by 2.60 basis points from the previous New York session close, while the 30-year yield declined by 1.30 basis points. The 2-year yield dropped by 4.00 basis points.

Amid a series of weaker-than-expected US economic indicators, foreign media reported that Kevin Hassett, White House National Economic Council (NEC) member and economic adviser to President Donald Trump, is emerging as a leading candidate for the next Fed chair.

Hassett, who has been regarded as favorable due to his loyalty to President Trump, is also considered the most dovish among the potential Fed chair nominees. He has actively supported Trump’s economic policies, including tariffs, and has aligned with the president’s criticism of the Fed.

sjkim@yna.co.kr

(End)

© Yonhap Infomax. All rights reserved. Unauthorized reproduction, redistribution, or AI training/use prohibited.

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.