(Seoul=Yonhap Infomax) Si Yoon Yoon – The cryptocurrency market saw Bitcoin prices rebound this week after a sharp decline, but gains remain limited.

Bitcoin, long considered the embodiment of the so-called "Tinkerbell effect"—the notion that value exists if enough people believe in it—is now facing a test of its sustainability.

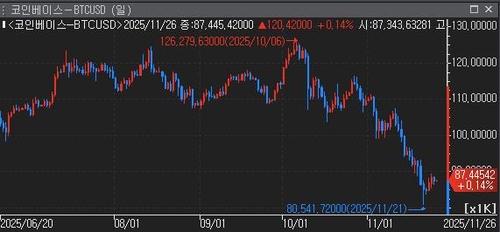

According to Yonhap Infomax (screen number 2521) on the 26th, Bitcoin fell as much as 2.4% intraday to $86,083.59 the previous day. This marks a drop of over 31% from its all-time high of $126,279.63 in October.

Market sentiment has weakened further as expectations grow that the US Federal Reserve (Fed) will hold off on a rate cut in December. On the 21st, Bitcoin dropped to $80,541.72, its lowest level in seven months.

As of 09:41 on the 26th, Bitcoin was trading at $87,416.25, up 0.11% from 24 hours earlier.

Image URL: http://newsimage.einfomax.co.kr/AKR20251126045500016_01_i.jpg

Strategists at Deutsche Bank have used the economic concept of the "Tinkerbell effect" to describe Bitcoin since its market capitalization surpassed $1 trillion in 2021. The term, derived from Peter Pan's "Tinkerbell exists because people believe she exists," reflects the logic that Bitcoin's price rose because many investors believed in its value and future appreciation.

Currently, crypto investors are reacting sensitively to Fed rate cut expectations, casting doubt on the continued existence of the "Tinkerbell effect."

John Williams, President of the Federal Reserve Bank of New York and a close associate of Fed Chair Jerome Powell, said on the 21st that "there is room to further adjust the target range for rates in the short term," which was interpreted as signaling openness to a December rate cut.

Amid hopes for lower rates, the S&P 500 and tech-heavy Nasdaq Composite have been rising.

However, Bitcoin has struggled to stage a significant rebound, remaining capped below the $90,000 level.

Correlation with other risk assets such as equities has also weakened, further eroding investor confidence.

Analysts note that many investors bought Bitcoin around the $90,000 level, which is now acting as resistance to further gains. With prices still below that threshold, renewed buying remains difficult.

According to Nikkei, Richard Teng, CEO of Binance, the world's largest crypto exchange, said, "Investors are reducing leverage in crypto assets and increasing risk aversion."

Michael Saylor, a prominent Bitcoin bull and CEO of MicroStrategy (NASDAQ: MSTR), the world's largest corporate holder of Bitcoin, also struck a cautious tone, saying, "It is difficult to predict prices through year-end."

Since November, investors have withdrawn a net $3.5 billion from US-listed Bitcoin exchange-traded funds (ETFs).

Bitcoin-related stocks have also underperformed in the US equity market. Coinbase Global (NASDAQ: COIN) shares have fallen 30% over the past month, while MicroStrategy shares are down 40%.

Market observers say whether investors continue to "believe in Tinkerbell" will depend entirely on the Fed's rate cut trajectory. If the release of delayed US economic data—previously held up by a government shutdown—raises the likelihood of a December rate cut, investor caution could ease.

syyoon@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.