(Seoul=Yonhap Infomax) Kyung Pyo Hong — Australia's Consumer Price Index (CPI) for October came in above market expectations, fueling gains in both the Australian dollar and government bond yields.

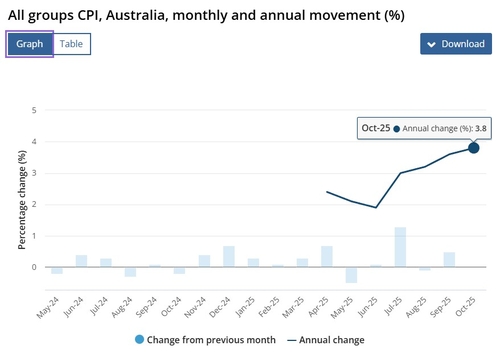

On the 26th, the Australian Bureau of Statistics (ABS) announced that the October CPI rose 3.8% year-on-year.

This figure surpassed both the previous reading of 3.5% and the market consensus of 3.6%.

Australia's monthly CPI started the year at 2.5% in January, remained in the 2% range through May, and dipped into the 1% range in June. However, it rebounded to the 3% range in August and has maintained an annual increase above 3% since then.

Annual goods inflation stood at 3.8%, with the primary driver being a 37.1% year-on-year surge in electricity prices.

Annual services inflation was 3.9%, led by rents (4.2%), medical and hospital services (5.1%), and domestic holiday travel and accommodation (7.1%).

The Australian dollar strengthened following the CPI release.

As of 09:44 local time, the AUD/USD exchange rate was up 0.22% at 0.6479.

Australian government bond yields also rose.

The 10-year yield climbed 3.58 basis points to 4.4744%, while the 2-year yield advanced 7.5 basis points to 3.7592% at the same time.

kphong@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.