(Seoul=Yonhap Infomax) The roles of former underperformers and top performers in the eurozone have been completely reversed. Recent assessments of the economic, fiscal, and financial market conditions across the 20 eurozone countries highlight this dramatic shift.

In the early 2010s, southern European nations such as Portugal, Italy, Greece, and Spain were at the epicenter of the eurozone’s sovereign debt crisis, sending shockwaves through global financial markets. These countries were derisively labeled as "PIGS" in financial circles, an acronym for Portugal, Italy, Greece, and Spain. Some even required bailouts from the International Monetary Fund (IMF).

In contrast, Germany and France, backed by sound economic and fiscal fundamentals, were the largest contributors to the European Financial Stability Facility (EFSF), which was established to support the PIGS. At the time, Germany and France were widely recognized as the eurozone’s model students.

However, over the past decade, the situation has been completely reversed. Southern European economies have seen significant improvement. Spain, in particular, has enjoyed robust growth since the COVID-19 pandemic, buoyed by a recovery in tourism. Spain’s GDP grew 3.2% last year, far outpacing the eurozone average of 0.9% during the same period.

Conversely, concerns over fiscal soundness are mounting in Germany and France, the former top performers during the southern European debt crisis. Germany posted near-zero growth last year, while France is expected to see growth below 1% this year. Notably, France suffered two consecutive sovereign credit rating downgrades—first by Moody’s in December last year, and again by Fitch last month.

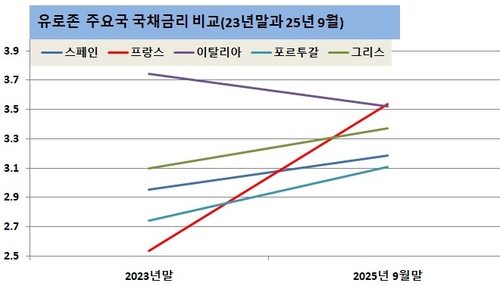

These divergent national trajectories are clearly reflected in financial market indicators such as government bond yields and stock prices. Despite the European Central Bank’s rate cuts, declines in German and French government bond yields have been limited. Meanwhile, yields on government bonds from southern European countries like Spain and Italy have fallen below those of France. For example, France’s 10-year government bond yield stands at 3.53%, while Portugal, Spain, and Greece post yields of 3.11%, 3.18%, and 3.37%, respectively.

The stock market tells a similar story. From the start of the year through the end of September, Greece’s stock index surged about 40%, the highest among the group. Spain gained 34%, while Italy and Greece each rose around 26%. In contrast, Germany’s index climbed 21%, and France lagged at just 8%.

Financial markets appear relatively unfazed by fiscal concerns in major eurozone economies such as Germany and France. The prevailing view is that, while France’s fiscal issues are serious, they are unlikely to trigger contagion across global financial markets.

However, with lingering anxiety over a potential repeat of the 2012 southern European debt crisis, some analysts warn that new crisis triggers could emerge from within the eurozone. Should such a scenario unfold, the impact could be even greater than the previous southern European crisis, given the larger scale of the economies involved.

The experience of the southern European debt crisis underscored the critical importance of fiscal soundness and the need for harmony between fiscal and other policy measures. At present, South Korea also faces the necessity of short-term fiscal stimulus. However, such measures should remain temporary, with strict management to ensure fiscal sustainability. The introduction of fiscal rules to manage national debt and bold structural reforms to eliminate budget waste are also essential.

Otherwise, South Korea could find itself entangled in fiscal problems, much like the southern European countries in the past or the current European economic heavyweights. The IMF has also warned, following its annual consultations with South Korea, that the country needs mid- to long-term fiscal and structural reforms. (Editor-in-Chief)

eco@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.