Infomax Column 목록 ( 총 : 542)

-

[Jong Hyuk Lee's Investment]If Growth and Liquidity Hold Up—Diminished Odds for Rate Cuts

South Korea’s central bank is widely expected to keep its base rate steady at 2.50% in November, as concerns over financial stability and a resilient growth outlook outweigh calls for rate cuts. The won’s weakness, real estate risks, and global political factors are prompting authorities to prioritize stability, with market participants split on the timing of any future easing.

-

[Yoo Kwon Ko's Companis]Stock Investment Migration and the High Exchange Rate

South Korea faces mounting economic pressure as the won-dollar exchange rate nears 1,500, with rising overseas investments and cost burdens fueling inflation risks and prompting calls for comprehensive policy reforms.

-

[Byoung Keuk Hwang's Fine & Seol]Kimchi Premium - Why Only South Korean Investors Pay More

South Korean investors continue to face the "Korea discount" and pay higher premiums on assets like Bitcoin and gold, highlighting persistent market inefficiencies and regulatory challenges that leave domestic participants at a disadvantage compared to global peers.

-

[Jang Won Lee's Viewpoint]Capital Flows Upward, Pain Flows Downward

The article analyzes the widening wealth gap in the US and South Korea, highlighting how fiscal policy, asset inflation, and AI-driven changes are deepening economic polarization, with capital gains accruing to the wealthy while the working class faces rising costs and job insecurity.

-

[Se Yeon Kwak's Prism]'Big Short' Michael Burry

Michael Burry, famed for "The Big Short," is now betting against the AI rally, warning of an overheated market and targeting Palantir and NVIDIA with put options, sparking volatility in U.S. tech stocks.

-

[Jong Hyuk Lee's Investment]If the Korea Exchange Were to List Itself

South Korea’s KOSPI index pauses near record highs as foreign outflows and valuation concerns mount; calls grow for the Korea Exchange to lead Value-Up reforms, including potentially listing itself, to close the persistent Korea Discount.

-

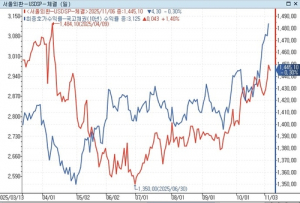

[Byoung Keuk Hwang's Fine & Seol]‘Triple Threat’ of High Rates, Inflation, and FX Risk Overshadowing Stock Market Gains

South Korea’s stock market rally is overshadowed by the resurgence of high interest rates, inflation, and a weak won, raising concerns about the sustainability of the economic recovery despite recent GDP growth and government stimulus efforts.

-

[Jang Won Lee's Viewpoint] 'Jobless Growth' Season 2

AI-driven automation is fueling a new era of 'jobless growth,' with major U.S. firms slashing jobs and youth employment falling, signaling a structural shift in labor markets.

-

[Se Yeon Kwak's Prism]Ladder

South Korea’s social mobility “ladder” is under scrutiny as soaring real estate prices, education inequality, and shifting government policies fuel public frustration, even as the KOSPI hits record highs and officials urge a move from property to equities for wealth accumulation.

-

[Jong Hyuk Lee's Investment]Next Year's Shareholder Meetings Set to Be Dominated by 'Funds'

South Korea's KOSPI index soared past 4,000 for the first time, driven by AI investment, global liquidity, and sweeping governance reforms, as activist funds—both foreign and domestic—prepare to reshape next year's shareholder meetings.

-

[Yoo Kwon Ko's Companis]Property Taxes Should Remain a 'Yellow Card'

South Korea's government is considering strengthening property holding taxes as a last resort to curb surging home prices, but experts warn such measures could fuel social conflict and urge a focus on supply-side solutions and demand management instead.

-

[Byoung Keuk Hwang's Fine & Seol]Stocks Outpace Housing Prices

South Korea’s KOSPI index has soared nearly 62% year-to-date, far outpacing housing price gains and shifting investor preference from real estate to equities amid robust capital inflows and regulatory changes.

-

[Jang Won Lee's Viewpoint]Fading Hopes for 'Uptober' Rally

Global markets lost momentum in October as Wall Street’s rally stalled, cryptocurrencies plunged, and concerns over AI bubbles and credit risks grew, with analysts warning of heightened volatility ahead.

-

[Se Yeon Kwak's Prism]The Era of Financial Repression

Global governments are turning to financial repression—artificially suppressing interest rates and distorting markets—to manage soaring sovereign debt, driving investors toward real assets like gold and Bitcoin as traditional safe havens lose appeal.

-

[Jong Hyuk Lee's Investment]Gangnam and Yongsan Hold the Key

The South Korean government’s latest real estate measures face skepticism as property prices in Seoul’s Gangnam and Yongsan districts continue to surge, with analysts calling for bold, unexpected supply-side solutions to address persistent market overheating.

-

[Yoo Kwon Ko's Companis]Who Holds the Economic Control Tower?

South Korea's Ministry of Economy and Finance faces an identity crisis as it loses key budget and financial policy powers, raising questions over who now controls economic policy coordination amid government restructuring.

-

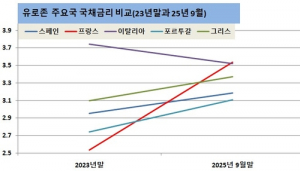

[Byoung Keuk Hwang's Fine & Seol]Eurozone Country Rankings Upended in a Flash

Southern European economies, once labeled as "PIGS," have outperformed former eurozone leaders Germany and France, as reflected in GDP growth, bond yields, and stock market gains, while fiscal concerns now shift to the bloc's largest economies.

-

[Se Yeon Kwak's Prism]For Korea's HENRYs

South Korea's high-earning professionals, or HENRYs, face rising tax burdens and limited benefits, fueling a shift toward stock investment as the government seeks to make equities a viable alternative to real estate for wealth accumulation.

-

[Jong Hyuk Lee's Investment]$350 Billion US Investment and the Risk of a Critical Crisis

South Korea faces significant financial risks as it seeks to raise $350 billion for a US investment fund, with concerns over foreign exchange market stability, rising interest rates, and the need for deeper market reforms to support the KOSPI’s growth ambitions.

-

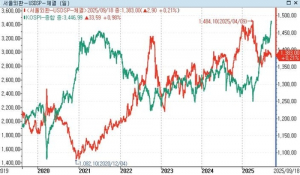

[Byoung Keuk Hwang's Fine & Seol]Dollar-Won Exchange Rate Decouples from Stock Market Rally

South Korea’s won remains weak despite record foreign inflows and a surging KOSPI, as large-scale U.S. investment commitments and tariff negotiations weigh on the currency.