(Seoul=Yonhap Infomax) Jang Won Lee Senior Reporter = Last month, global equity markets were marked by heightened caution. The New York stock market staged a sharp rally following the tariff-induced plunge in early April, fueling concerns over stretched valuations. With September historically prone to sharp corrections, analysts widely warned that a cautious approach was warranted this year as well.

Contrary to expectations, however, Wall Street continued its upward march. The Nasdaq Composite repeatedly set new record highs, propelling Asian markets such as Japan and Taiwan, as well as South Korea’s domestic market, to all-time peaks. Not only equities but also cryptocurrencies and gold prices surged, resulting in an “everything rally.”

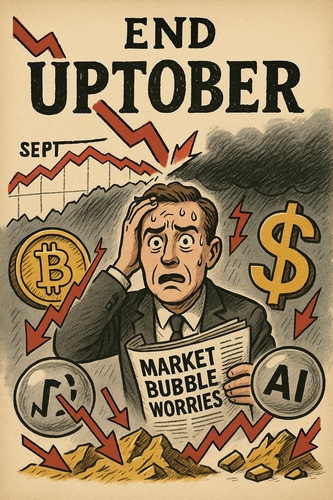

Many anticipated that this bullish momentum would carry into October. Yet, once again, forecasts missed the mark. The U.S. stock market’s rally stalled as U.S.-China trade tensions resurfaced. The situation was exacerbated by renewed concerns over regional banks’ asset quality, sharply deteriorating investor sentiment. On October 10 (local time), the Nasdaq tumbled 3.6%, while Bitcoin, after hitting an all-time high of $126,300 on October 6, plunged to the $106,000 level. Ethereum, which had drawn market attention following Bitcoin, also slid from $4,800 to $3,500.

On October 10, the crypto market saw forced liquidations totaling approximately $19 billion (27 trillion won), triggering a cascade of sell-offs. This has led to increasingly pessimistic outlooks, with some predicting a prolonged bear market extending into next year.

Gold prices, which had continued to set record highs through mid-October, have recently lost momentum.

Fortunately, President Donald Trump’s signals of easing the tariff war have sparked a recovery in equities and other asset classes this week. However, with latent risks still present, it is too early for investors to be complacent.

Amid weakening market momentum, Wall Street has begun to openly discuss previously sidelined issues such as the artificial intelligence (AI) bubble and credit risks.

Jamie Dimon, CEO of JPMorgan Chase & Co., recently warned that elevated asset prices are “in the realm of concern,” noting that many assets have entered bubble territory.

According to Bank of America’s latest survey, for the first time ever, the “AI stock bubble” was cited as the top global tail risk—an event with a low probability but potentially severe market impact.

Fund managers’ cash holdings have dropped to just 3.8%, nearing Bank of America’s “sell” threshold. This indicates that investors have maximized their exposure to risk assets amid extreme optimism, suggesting limited further buying power in the market.

The market is thus in a highly fragile state, where even minor shocks could trigger large-scale selling pressure, rather than allowing for orderly corrections.

Despite a flurry of major AI investments—such as Google’s $15 billion commitment and OpenAI’s $1.5 trillion infrastructure plan—some observers interpret these as signs of a bubble.

On the issue of regional banks’ bad loans, JPMorgan CEO Dimon remarked, “If you see one cockroach, there are probably more,” heightening market anxiety.

Meanwhile, in the crypto market, the term “Downtober”—a play on “Uptober”—has gained traction, reflecting the end of the bullish phase. Crypto traders argue that, with no new liquidity entering the market and all assets having reached their peaks, the rally is over. Some have responded by taking “max shorting” positions.

According to analysis by CoinDesk and others, Bitcoin typically peaks 12–18 months after a halving event, then enters a correction phase. Given last April’s halving, current market moves may represent a key inflection point in this cycle.

*

jang73@yna.co.kr

(End)

© Yonhap Infomax. All rights reserved. Unauthorized reproduction, redistribution, or AI training/use prohibited.

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.