(Seoul=Yonhap Infomax) There were two young men who fit the description of rookie investors more than fund managers: Jamie and Charlie. Until recently, they lived with their mothers and were often scolded, but through high-risk, high-reward options trading, they turned an initial investment of $110,000 into $30 million. While their success was partly accidental, their youthful energy led them to discover the potential of out-of-the-money options.

Introducing themselves as managers of the obscure Brownfield Fund, Jamie and Charlie attempted to join the International Swaps and Derivatives Association (ISDA) by visiting JPMorgan Chase, only to be met with humiliation. Gifted at seeing what others overlooked, they stumbled upon an investment prospectus in the JPMorgan Chase lobby, which argued for shorting the U.S. housing market due to an impending collapse. This was their first sign of the coming crisis.

The prospectus was authored by a physician-turned-fund manager with a glass eye, who was the first to detect the housing market's impending collapse. That man was Michael Burry, who has once again taken center stage in the market by raising concerns about a 2025 bubble, short selling, and inflated earnings.

The 2016 film "The Big Short" is based on real people, with Michael Burry being one of the four so-called "eccentric geniuses." While the story mainly follows Jamie and Charlie, Burry is both the starting point and the conclusion of "The Big Short."

Running a hedge fund, Burry found there were no insurance or options products to short U.S. mortgages, so he approached investment banks to create a swap product. He then entered into credit default swap (CDS) contracts with securities firms, betting that AAA-rated mortgage-backed securities would deteriorate. Inspired by Burry's strategy, a Deutsche Bank trader developed a bond short-selling product, which attracted investment from a Morgan Stanley fund team, while Charlie and Jamie also shorted mortgage bonds with the help of a retired trader.

When the crisis materialized, these investors made astronomical profits. Michael Burry, the "eccentric investor," gained global recognition, not just on Wall Street.

"You just bet against the American economy. Do you know what happens if the U.S. economy collapses? People lose their homes, their pensions, their jobs. Don't dance." As this line from the film highlights, "The Big Short" shed light on those who profited from a national economic crisis. The collapse of Lehman Brothers, which shattered the myth of "too big to fail," remains vivid in memory, and the film resonated even a decade later. Even now, when investors think of contrarian bets against market euphoria and greed, "The Big Short" comes to mind first.

Now, Michael Burry is warning of overheating in the artificial intelligence (AI) rally, betting on declines in Palantir Technologies Inc. and NVIDIA Corp. According to recently disclosed SEC filings, Burry's Scion Asset Management holds put options on NVIDIA and Palantir. While these filings reflect holdings as of the end of the third quarter and current positions may have changed, the market reacted immediately.

Burry also broke his silence for the first time since April 2023, posting a still from "The Big Short" of actor Christian Bale staring at a computer screen on his X account, along with the message: "Sometimes you can see the bubble. Sometimes you can do something about it. Sometimes the only way to win is not to play."

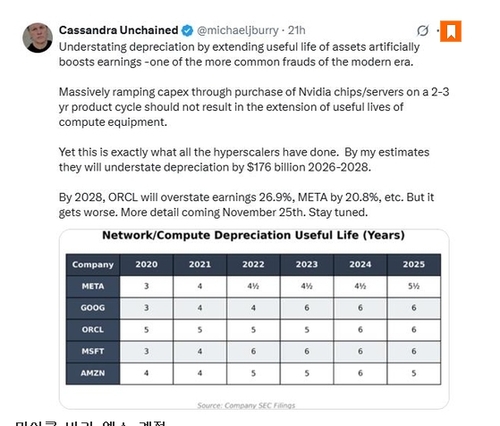

On the 10th, Burry further criticized, "Artificially extending the useful life of assets to reduce depreciation expenses is one of the most common frauds in modern accounting." He warned that hyperscalers such as Amazon.com Inc., Microsoft Corp., Alphabet Inc., and Meta Platforms Inc. are inflating earnings by extending the useful life of AI semiconductors and servers, thereby reducing annual depreciation costs.

Burry, known for his ability to spot bubbles early, has now placed bearish bets on AI leaders that have driven U.S. and global equity markets. Although tech stocks rebounded sharply after initial declines due to bargain hunting, Burry's AI bubble warning continues to reverberate through the market.

Attention is also focused on whether the prophecy of "Cassandra Unchained," Burry's X account profile, will come true again. In Greek mythology, Cassandra was the daughter of Troy's last king, Priam. The sun god Apollo granted her the gift of prophecy, but after she rejected his advances, he cursed her so that no one would believe her predictions.

Michael Burry has not always been right—he once conceded defeat during Tesla Inc.'s stock surge, and some say he was only correct once, in 2008. Nevertheless, Burry remains at the center of the market because, at a time when global indices were reaching unprecedented highs and euphoria over AI was rampant, he had the courage to say "no" when everyone else said "yes."

Crises always grow at the heart of bubbles, and like Troy, which ignored Cassandra's warnings, markets tend to believe only what they want to believe. The real danger is born the moment that optimism goes unquestioned. (Securities Editor)

sykwak@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.