(New York=Yonhap Infomax) Jin Woo Choi – The US dollar extended its gains for a third consecutive session.

The US Dollar Index (DXY), which measures the greenback against six major currencies, moved closer to the 100 mark, buoyed by a weaker yen and a series of hawkish remarks from key Federal Reserve officials.

The Japanese yen continued to weaken, with the Bank of Japan’s dovish stance outweighing verbal intervention efforts by Japan’s Ministry of Finance.

According to Yonhap Infomax (screen number 6411), as of 16:00 Eastern Time on the 31st, the dollar-yen exchange rate stood at 154.112 yen, up 0.047 yen (0.031%) from the previous New York close of 154.065 yen.

Despite earlier comments from Finance Minister Satsuki Katayama—who stated, “We will closely monitor excessive volatility and speculative moves, including disorderly market movements”—the dollar-yen pair remained elevated above 154 in New York trading.

Claudio Piron, strategist at Bank of America, noted, “Short-term rate fluctuations are the main driver of Asian currency weakness, as Asian central banks have been more aggressive in cutting rates than the Fed.”

The euro-yen rate fell 0.560 yen (0.314%) to 177.62 yen, while the euro-dollar rate declined 0.00385 dollars (0.333%) to 1.15256 dollars.

According to Eurostat, the European Union’s statistics agency, the preliminary Consumer Price Index (CPI) for the month rose 2.1% year-on-year, in line with market expectations.

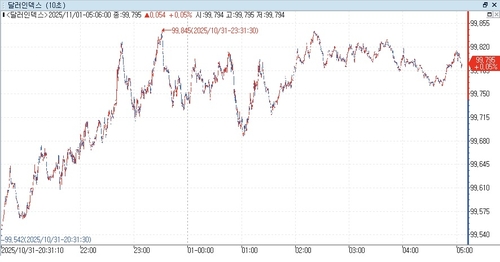

The Dollar Index climbed 0.261 points (0.262%) to 99.811.

The dollar’s strength persisted in New York trading, supported by the yen’s weakness.

Further momentum came from a series of hawkish statements by key Fed officials.

Lorie Logan, President of the Dallas Fed, said, “Unless there is clear evidence that inflation is falling faster than expected or the labor market is cooling much more rapidly, it will be difficult to cut rates again in December.”

Beth Hammack, President of the Cleveland Fed, commented, “It would have been better to hold (policy) rates steady at this FOMC meeting.”

Neither Hammack nor Logan holds a voting seat on the FOMC this year, but both will gain voting rights next year.

Jeffrey Schmid, President of the Kansas City Fed, who opposed a rate cut at this month’s FOMC, added, “Inflation remains high and there are concerns about its potential to spread. If the Fed’s commitment to the 2% inflation target is questioned, a rate cut could be counterproductive.”

The Dollar Index briefly touched 99.845 during the session as these comments coincided with the yen’s weakness.

Gregory Faranello, Head of US Rates Strategy at AmeriVet Securities, said, “Talk of lower US rates is only possible if there is an economic slowdown. The recent pullback in aggressive rate cut expectations is a rational adjustment.”

Jayati Bharadwaj, strategist at TD Securities, stated, “The dollar rally is likely to continue for now, with the focus currently more on external factors such as France, Japan, and the UK, rather than domestic US developments.”

US President Donald Trump indicated that he could fully remove tariffs on fentanyl imports from China. The US had previously reduced the fentanyl tariff from 20% to 10% following a summit with China.

The offshore dollar-yuan (CNH) rate rose 0.0122 yuan (0.172%) to 7.1235 yuan.

The dollar-Canadian dollar rate increased 0.0037 Canadian dollars (0.265%) to 1.4025 Canadian dollars. President Trump also stated that he would not resume trade negotiations with Canada.

The pound-dollar rate slipped 0.00082 dollars (0.062%) to 1.31364 dollars.

jwchoi@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.