Other 목록 ( 총 : 298)

-

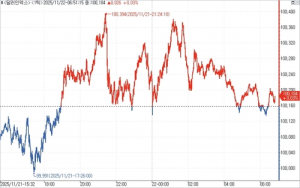

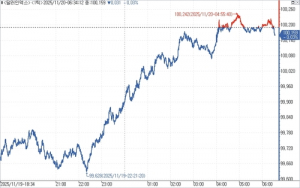

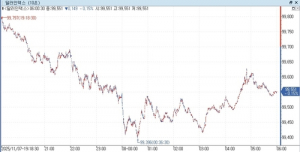

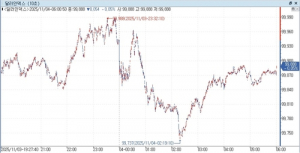

[New York FX] Dollar Falls—Ceasefire Hopes in Ukraine and Weak US Data Pressure Greenback as Hassett Eyed for Fed Chair

The US dollar fell below the 100 mark as hopes for a Russia-Ukraine ceasefire and weak US economic data pressured the greenback, while speculation over Kevin Hassett as the next Fed Chair added to the decline. Key currency pairs saw notable moves, and market participants are watching upcoming policy events.

-

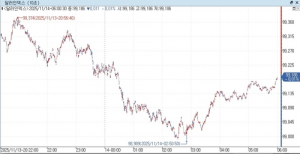

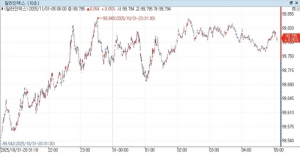

[New York FX] Dollar Holds Firm—Trades in Range Ahead of Expected Fed Rate Cut in December

The US dollar traded in a narrow range in New York as expectations for a December Federal Reserve rate cut grew, with the dollar-yen briefly topping 157 before retreating; the dollar index edged higher, while market focus shifted to upcoming US and UK policy events.

-

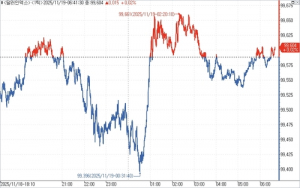

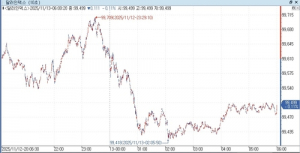

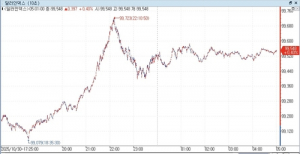

[New York FX] Dollar Falls for First Time in Six Sessions as Fed Rate Cut Bets Surge, BOJ Signals Hike

The US dollar weakened for the first time in six sessions as Fed rate cut expectations surged to 70%, while the yen rallied on hawkish BOJ signals, halting the euro-yen's record run and driving notable FX market volatility.

-

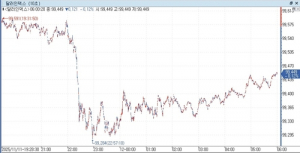

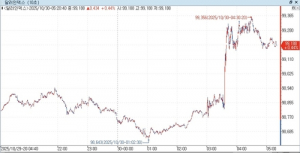

[New York FX] Dollar Edges Higher—Rebounds Amid Yen Weakness and Sharp Equity Selloff

The US dollar rebounded amid a sharp selloff in New York equities, extending its gains for a fifth session, while the yen weakened to multi-year lows and the euro-yen hit record highs as mixed US jobs data fueled market volatility.

-

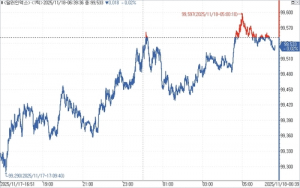

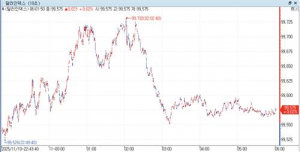

[New York FX] Dollar Rises for Fourth Straight Session—DXY Tops 100 on Fed Hold Expectations

The US dollar climbed for a fourth straight session, with the DXY surpassing 100 as expectations for a Fed rate hold solidified; the yen and pound slumped on fiscal concerns, while the euro-yen hit a record high.

-

[New York FX] Dollar Rises for Third Day Amid Yen Weakness—Rebounds Intraday Despite Private Employment Decline

The US dollar climbed for a third straight day in New York trading, rebounding intraday as Treasury yields recovered, while the yen hit a nine-month low amid policy uncertainty and the euro-yen set a new all-time high.

-

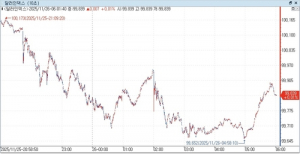

[New York FX] Dollar Rises—‘Yen Weakness Deepens’ as USD/JPY Hits 155, Yen at Record Low Against Euro

The US dollar advanced for a second day as the yen weakened sharply, with USD/JPY breaching 155 and the yen hitting a record low against the euro, amid expectations of continued pro-growth policies from Japan’s new leadership and ahead of key US jobs data.

-

[New York FX] Dollar Edges Higher—Risk Aversion Eases, Taiwan Dollar Surges on 'FX Agreement'

The US dollar edged higher in New York as risk aversion eased and hawkish Fed comments dampened rate cut hopes, while the Taiwan dollar surged after a US-Taiwan FX agreement. Key currencies and yields fluctuated amid shifting fiscal and monetary policy signals.

-

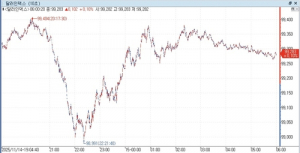

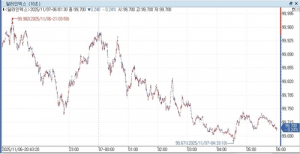

[New York FX] Dollar Falls—DXY Dips Below 99 Amid 'Data Uncertainty' Turmoil

The US dollar weakened sharply in New York as the Dollar Index (DXY) fell below 99 amid heightened uncertainty from a lack of key economic data, with markets pricing in a near-even chance of a Fed rate cut in December.

-

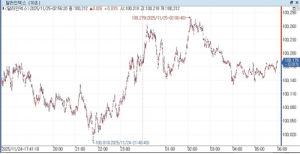

[New York FX] Dollar Holds Firm—'Cooperation with BOJ' Says Japanese PM as Dollar-Yen Hits 155 Intraday

The US dollar held firm against the yen, briefly surpassing 155 for the first time in nine months after Japan's prime minister pledged cooperation with the BOJ, while oil price declines and US Treasury yield drops tempered inflation concerns and shifted FX market sentiment.

-

[New York FX] Dollar Falls on Weak US Private Employment Data—Pound Also Softens Amid UK Jobs Slump

The US dollar weakened as disappointing private employment data and expectations for a Fed rate cut pressured the greenback, while the pound fell further after UK unemployment hit a multi-year high. Market sentiment improved on hopes for an end to the US government shutdown, but analysts remain cautious on the dollar's outlook.

-

[New York FX] Dollar Rises for First Time in Four Sessions—Shutdown Hopes, Fiscal Concerns Weigh on Yen

The US dollar rebounded for the first time in four sessions as hopes for a US government shutdown resolution eased economic concerns, while the yen weakened on worries over Japan’s fiscal policy; key FX rates and analyst commentary highlight cautious market sentiment.

-

[New York FX] Dollar Falls for Third Straight Session—Risk Aversion on Economic Worries VS Shutdown Resolution Hopes

The US dollar fell for a third straight session amid economic concerns and safe-haven flows, but trimmed losses on hopes for a US government shutdown resolution; the dollar index ended in the mid-99 range, while the Canadian dollar surged on strong labor data.

-

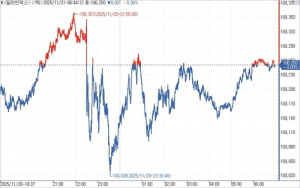

[New York FX] Dollar Falls for Second Day—US Labor Market Cools Amid Record Layoff Announcements

The US dollar fell for a second straight day as record-high layoff announcements and cooling labor market data fueled concerns, pushing the dollar index below 100 and reviving expectations for Federal Reserve rate cuts. The pound weakened after the Bank of England held rates steady, while the offshore yuan also declined. Key analysts noted rising risks and the potential for policy shifts if labor market weakness persists.

-

[New York FX] Dollar Falls for First Time in Six Sessions as Trump Tariff Policy Faces Legal Setback

The US dollar fell for the first time in six sessions as strong US jobs and services data initially boosted the greenback, but legal challenges to Trump-era reciprocal tariffs and renewed fiscal concerns weighed on the currency, while US Treasury yields rose and major central bank comments shaped market sentiment.

-

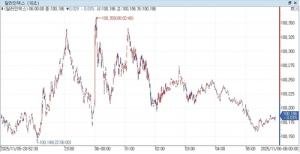

[New York FX] Dollar Rises for Fifth Day—DXY Surges Past 100 Amid Pound Plunge and Safe-Haven Demand

The US dollar surged for a fifth straight session, with the Dollar Index (DXY) breaking above 100 for the first time in three months amid a sharp drop in the pound and heightened safe-haven demand, as global equity markets declined and investors rotated into government bonds.

-

[New York FX] Dollar Rises for Fourth Straight Session—December Rate Cut Uncertainty VS US Manufacturing Slump

The US dollar rose for a fourth straight session amid uncertainty over a December Fed rate cut, with gains tempered by weaker-than-expected US manufacturing data; the dollar index and major currency pairs saw modest moves as markets weighed hawkish Fed signals against economic softness.

-

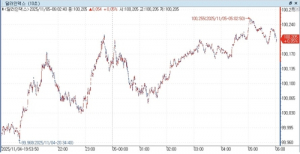

[New York FX] Dollar Rises for Third Day—DXY Nears 100 on Successive Hawkish Fed Comments

The US dollar advanced for a third straight session, with the Dollar Index nearing 100 as hawkish Federal Reserve comments and a weaker yen drove gains. Key Fed officials signaled caution on rate cuts, while the yen fell despite Japanese intervention efforts. The euro and pound also weakened against the dollar, and the offshore yuan slipped. Market participants expect the dollar rally to persist amid global uncertainties.

-

[New York FX] Yen Plunges as Dollar Rises for Second Day—Dovish BOJ vs Hawkish Fed

The US dollar strengthened for a second day as the yen plunged on fading BOJ rate hike hopes, while hawkish Fed signals and rising Treasury yields fueled further dollar gains.

-

[New York FX] Dollar Rises for First Time in Four Sessions—Fed’s ‘Hawkish Cut’ Lifts DXY Back to 99

The US dollar rebounded for the first time in four sessions, with the Dollar Index climbing to 99 after hawkish signals from the Fed, while the Canadian dollar erased gains following a ‘hawkish cut’ by the Bank of Canada.