(New York=Yonhap Infomax) Jin Woo Choi—The US dollar held firm in New York trading, moving within a narrow range as expectations for a Federal Reserve rate cut in December grew, just three days ahead of the Thanksgiving holiday. Trading volumes remained subdued.

According to Yonhap Infomax (Screen No. 6411), as of 16:00 Eastern Time on the 24th, the dollar-yen exchange rate stood at 156.8320 yen, up 0.4420 yen (0.283%) from the previous New York close of 156.3900 yen.

The dollar-yen briefly surpassed the 157 yen level during the session, but quickly retreated to the 156 yen range amid caution over potential intervention by Japanese authorities.

Akira Moroga, Chief Strategist at Aozora Bank, commented, "There are currently no clear catalysts for yen buying, so the risk of further yen weakness remains. Expectations for a Bank of Japan rate hike have become excessively low. Should any factors emerge to revive those expectations, the yen could rebound sharply."

The euro-dollar exchange rate edged up to 1.15223 dollars, a gain of 0.00038 dollars (0.033%) from the previous session.

Joachim Nagel, President of Germany’s Bundesbank, noted, "The recent surge in inflation has not yet fully dissipated," highlighting continued pressure on consumer prices.

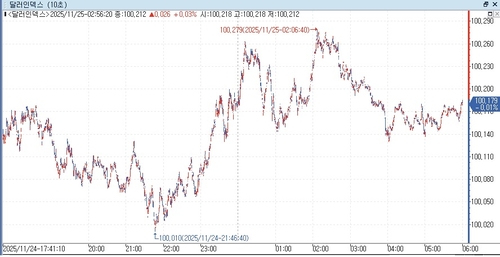

The dollar index (DXY), which tracks the greenback against six major currencies, rose 0.027 points (0.027%) to 100.184.

Early in the session, the dollar index climbed as high as 100.279, tracking a rise in US Treasury yields amid increased risk appetite.

However, as expectations for a Fed rate cut gained traction, the dollar came under pressure alongside a decline in Treasury yields.

Christopher Waller, a key Federal Reserve Governor, told Fox News that he supports a December rate cut, citing signs of labor market deterioration.

On the same day, Mary Daly, President of the Federal Reserve Bank of San Francisco, also pointed to the risk of a sharp labor market downturn, lending further support to the case for a December rate cut.

Overall, the dollar remained range-bound, lacking a clear directional bias.

Marc Chandler, Chief Market Strategist at Bannockburn Global Forex, said, "The probability of a rate cut next month has increased somewhat today, but the impact on the dollar appears minimal. This remains an uncertain issue."

Eugene Epstein, Head of Trading and Structured Products at Moneycorp, noted divisions within the Fed, stating, "If the Fed is entering a rate-cutting phase, the dollar should weaken, but there have been times when it moved contrary to expectations."

According to CME FedWatch, as of 15:56 in New York, the federal funds rate futures market priced in an 84.9% probability of a 25bp rate cut by the Fed in December, up 13.9 percentage points from the previous day’s 71.0%.

US President Donald Trump said he had a positive phone call with Chinese President Xi Jinping and announced plans to visit China in April next year.

The pound-dollar exchange rate rose 0.00033 dollars (0.025%) to 1.31084 dollars.

Market participants are closely watching the UK Autumn Budget, set to be released on the 26th.

According to The Guardian, the UK Office for Budget Responsibility (OBR) is expected to revise down its five-year growth outlook from previous forecasts.

Nick Lees, Head of Macro at Monex, said, "The direction of the pound will depend on the downside risks to the UK economy presented in this budget. That’s what the market is focused on."

He added, "From a market perspective, attention will not just be on the budget details, but on the government’s overall economic outlook. That outlook could trigger an immediate reaction in the pound."

The offshore dollar-yuan (CNH) exchange rate was unchanged from the previous session at 7.1047 yuan.

jwchoi@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.