(New York=Yonhap Infomax) Jin Woo Choi – The US dollar weakened in New York trading.

Expectations for a peace agreement between Russia and Ukraine intensified, while disappointing US employment and consumption data further weighed on the dollar.

Reports that Kevin Hassett, Chairman of the White House National Economic Council (NEC), is a leading candidate for the next Federal Reserve (Fed) Chair also added to the dollar’s downside. The US Dollar Index (DXY), which tracks the greenback against six major currencies, fell below the 100 mark.

According to Yonhap Infomax (screen number 6411), as of 16:00 Eastern Time on the 25th, the dollar-yen exchange rate stood at 156.101 yen, down 0.731 yen (0.466%) from the previous New York close of 156.832 yen.

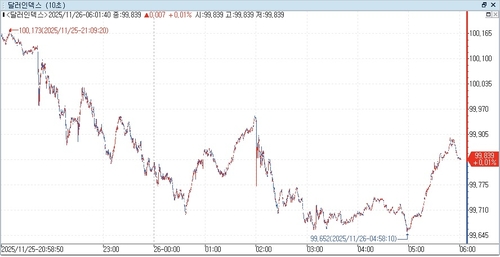

The Dollar Index dropped 0.342 points (0.341%) to 99.842.

The dollar came under pressure just before the New York session on news of a potential ceasefire agreement between Russia and Ukraine.

US broadcaster ABC reported that “the Ukrainian delegation has agreed with the US on the terms of a potential peace agreement.”

A US official told ABC, “Ukraine has agreed to the peace deal,” adding, “There are a few details to finalize, but they have agreed to the peace agreement.”

On the New York Mercantile Exchange, January West Texas Intermediate (WTI) crude futures plunged to the $57 per barrel range, easing inflation concerns. This, combined with falling US Treasury yields, pushed the Dollar Index below 100.

Weak US economic data further accelerated the dollar’s decline.

According to private payroll provider ADP, for the four weeks ending on the 8th of this month, US private employment fell by an average of 13,500 per week.

US retail sales for September, seasonally adjusted, totaled $733.3 billion, up 0.2% from the previous month but below the forecast (+0.4%).

In contrast, the September Producer Price Index (PPI) rose 0.3% month-on-month, in line with market expectations.

Reports that Hassett is a leading candidate for the next Fed Chair also negatively impacted the dollar. Hassett has downplayed inflation risks and advocated for rate cuts by the Fed.

According to CME FedWatch, as of 16:01 in New York, the federal funds rate (FFR) futures market priced in an 82.7% probability of a 25bp rate cut by the Fed in December.

Reflecting these factors, the Dollar Index fell as low as 99.652 during the session.

The euro-dollar exchange rate rose 0.00428 dollars (0.371%) to 1.15651 dollars.

On easing geopolitical tensions from the Russia-Ukraine ceasefire prospects, the euro-dollar rate briefly climbed to 1.5870 dollars.

Gabriel Makhlouf, Governor of the Central Bank of Ireland and ECB policymaker, said, “I am somewhat concerned about the current level of services inflation,” adding, “It is higher than it should be.”

The euro-yen rate fell 0.180 yen (0.100%) to 180.52 yen.

The pound-dollar exchange rate rose 0.00537 dollars (0.410%) to 1.31621 dollars.

Market participants are closely watching the UK government’s Autumn Budget on the 26th.

Francesco Pesole, FX strategist at ING, noted heightened market concerns over the pound, pointing to a sharp rise in related option volatility.

He explained, “The one-day implied volatility for euro-pound is much higher than realized volatility, the highest since the 2022 mini-budget crisis under Prime Minister Liz Truss.”

The offshore dollar-yuan (CNH) rate fell 0.0200 yuan (0.282%) to 7.0847 yuan.

jwchoi@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.