(New York=Yonhap Infomax) Jin Woo Choi – The US dollar declined for the first time in six trading days.

The greenback initially strengthened, buoyed by robust US private employment and services sector data, which pushed US Treasury yields higher. However, the dollar reversed course and edged lower as concerns mounted over the potential invalidation of the Trump administration’s reciprocal tariff policy.

According to Yonhap Infomax (screen number 6411), as of 16:00 on the 5th (US Eastern Time), the dollar-yen exchange rate stood at 154.124 yen, up 0.496 yen (0.323%) from the previous New York close of 153.628 yen.

The euro-dollar rate was $1.14884, up $0.00086 (0.075%) from the previous session.

Joachim Nagel, President of Germany’s Bundesbank, dismissed concerns that eurozone inflation would fall short of target, stating, “In the medium term, we are quite close to the target.” François Villeroy de Galhau, Governor of the Bank of France, also cautioned against “complacency” regarding inflation.

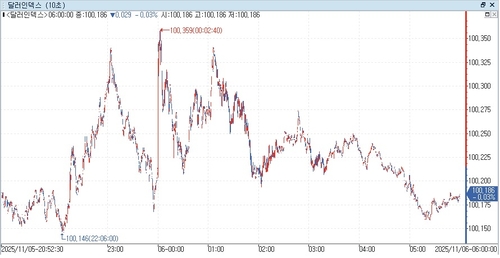

The dollar index (DXY), which measures the greenback against six major currencies, slipped 0.029 points (0.029%) to 100.186 from the previous session.

The dollar gained early in the New York session in response to strong US private employment and services PMI data.

According to ADP, private payrolls rose by 42,000 in October, beating market expectations (+25,000). The previous month’s figure was revised up from -32,000 to -29,000.

The Institute for Supply Management (ISM) reported that the US services PMI for October came in at 52.4, up 2.4 points from September’s 50.0 and above the consensus forecast of 50.8. A PMI above 50 indicates expansion.

Carl Shamotta, Chief Market Strategist at Corpay, commented, “A range of available indicators point to resilience in the US labor market,” adding, “It is becoming increasingly difficult to argue for an aggressive monetary policy path.”

The dollar index briefly climbed to 100.359 during the session as expectations for a Federal Reserve rate cut receded.

Subsequently, the dollar began to move in response to arguments before the US Supreme Court regarding the legality of reciprocal tariffs.

Justices largely expressed skepticism toward the Trump administration’s rationale for imposing reciprocal tariffs.

Chief Justice John Roberts stated, “The act of imposing taxes on the people has always been a core power of Congress,” adding, “These tariffs appear to generate revenue, which is clearly defined by the Constitution as a congressional function.” This raised the possibility that former President Donald Trump’s reciprocal tariffs may have infringed on congressional authority.

If the administration loses the case, the government may have to refund tariff revenues, reviving fiscal concerns. This pushed US Treasury yields higher and exerted downward pressure on the dollar.

Stephen Englander, strategist at Standard Chartered (SC), said, “If oral arguments lead to expectations that the tariffs will be ruled illegal, US Treasury yields will rise and the dollar could fall significantly.”

Scotiabank noted in a report, “If the dollar index breaks above the low-100s, a significant rebound could unfold in the coming weeks,” but added, “If the rally stalls and reverses near the 100 level, the sideways range seen since mid-year is likely to persist.”

The pound-dollar rate rose $0.00313 (0.240%) to $1.30502 from the previous session.

Market participants are closely watching the Bank of England’s (BOE) monetary policy meeting on the 6th. The likelihood of a rate hold currently outweighs expectations for a cut.

Grant Slade, UK economist at Morningstar, said, “We expect the BOE to keep the policy rate at 4%,” but noted, “This decision will be much more finely balanced than at the September meeting.”

The offshore dollar-yuan (CNH) rate fell 0.0047 yuan (0.066%) to 7.1303 yuan.

jwchoi@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.