(New York=Yonhap Infomax) Jin Woo Choi—The US dollar declined for a second consecutive session.

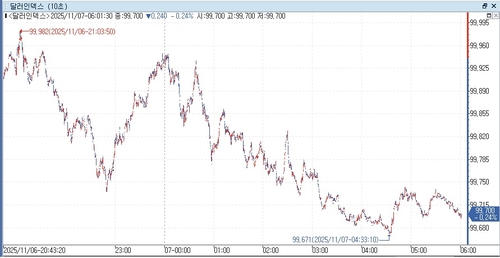

Concerns over the US labor market intensified after reports showed a surge in corporate layoff plans, sending the dollar index (DXY), which tracks the greenback against six major currencies, tumbling into the 99 range.

The British pound faced temporary downward pressure following the Bank of England's dovish decision to hold rates steady.

According to Yonhap Infomax (screen number 6411), as of 16:00 on the 6th (US Eastern Time), the dollar-yen exchange rate stood at 153.031 yen, plunging 1.093 yen (0.709%) from the previous New York close of 154.124 yen.

The euro-dollar rate rose to 1.15476, up 0.00592 (0.515%) from the prior session.

The dollar index fell 0.486 points (0.485%) to 99.700.

The dollar reacted to the latest layoff report from Challenger, Gray & Christmas (CG&C).

According to the report, US companies announced plans to cut 153,074 jobs in October, up 183% from the previous month and 175% from a year earlier. This marks the highest October figure since 2003, a 22-year high.

Subsequent employment data also pointed to a cooling labor market.

The Federal Reserve Bank of Chicago estimated the US real-time unemployment rate for October at 4.36%, up 0.01 percentage points from September (4.35%). Rounded, this would be 4.4%, the highest since October 2021 (4.5%) if officially confirmed.

Labor analytics firm Revelio Labs estimated, using its RPLS model, that nonfarm payrolls fell by 9,100 in October—the first decline since May (-15,400).

Expectations for Federal Reserve rate cuts resurfaced, pushing the dollar index as low as 99.671 intraday, in tandem with falling US Treasury yields.

Fawad Razaqzada, analyst at Forex.com, commented, "This shows it's not just about rate cut expectations. Reality is starting to bite the market. We're back in risk-off mode."

Donald Rismiller, analyst at Strategas, said, "The US labor market isn't collapsing, but it doesn't look robust enough to withstand shocks. While some FOMC members hesitate to cut rates in December, if the labor market wobbles, they'll have no choice but to act."

The pound-dollar rate rose 0.00859 (0.658%) to 1.31361.

The Bank of England held its policy rate at 4.00% at its Monetary Policy Committee meeting.

The committee suggested inflation may have peaked, stating, "If disinflation continues to progress, rates are likely to follow a gradual downward path." The word "careful" was removed from the previous statement.

The pound-dollar rate briefly fell to 1.30597 after the rate decision.

Danske Bank analyst Kristine Kunzby Nielsen said, "The pound remains under pressure. The dovish tone persists within the committee, and a near-term rate cut has only been postponed to the next meeting."

The offshore dollar-yuan (CNH) rate fell 0.0084 (0.118%) to 7.1219.

jwchoi@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.