(New York=Yonhap Infomax) Jin Woo Choi—The US dollar declined for a third consecutive trading day.

The greenback came under pressure from the outset of trading on concerns over the US economic outlook, but pared some losses in the afternoon session as expectations grew for a resolution to the US federal government’s temporary shutdown.

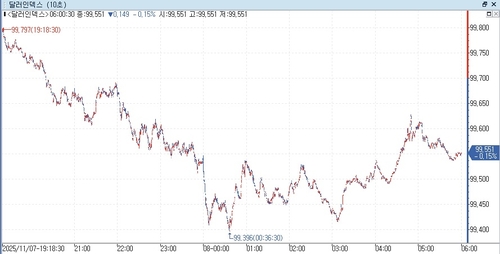

The dollar index (DXY), which measures the dollar against a basket of six major currencies, ended in the mid-99 range. The Canadian dollar posted significant gains against the greenback after data showed improvements in Canada’s labor market.

According to Yonhap Infomax (screen number 6411), as of 16:00 on the 7th (US Eastern Time), the dollar-yen exchange rate stood at 153.430 yen, up 0.399 yen (0.261%) from the previous New York close of 153.031 yen.

The euro-dollar rate rose to $1.15644, up $0.00168 (0.145%).

The dollar index fell 0.149 points (0.149%) to 99.551.

The dollar remained under downward pressure in New York trading, weighed by safe-haven demand amid labor market concerns and a decline in US Treasury yields.

Sentiment weakened further after US consumer confidence data hit its lowest level in three years and five months, sending the dollar index down to an intraday low of 99.396.

According to the University of Michigan, the preliminary US consumer sentiment index for November came in at 50.3, the lowest since June 2022’s 50.0.

The dollar’s losses narrowed on optimism over President Donald Trump and hopes for a shutdown resolution.

When asked at the White House whether he was concerned about an AI bubble, President Trump replied, “No. I like AI very much.”

The tech-heavy Nasdaq Composite began to rebound on Trump’s upbeat tone, and after Senate Democratic Leader Chuck Schumer proposed a compromise to end the shutdown, the index recovered to near flat levels.

The S&P 500 and Dow Jones indices also turned positive. As risk aversion eased, the dollar index rebounded intraday to 99.628.

David Russell, global strategist at TradeStation, said, “The longer the government shutdown drags on, the greater the impact on the real economy, posing even bigger risks.”

The pound-dollar rate rose to $1.31634, up $0.00273 (0.208%) from the previous session.

The UK faces turmoil ahead of its budget announcement on the 26th of this month.

Chancellor Rachel Reeves is pushing for an income tax hike, breaking with Labour’s campaign pledges, but Deputy Leader Lucy Powell countered, “Of course, we must honor our pledges.”

Amid renewed fiscal concerns, UK gilt yields climbed, but the pound strengthened on dollar weakness. Tom Matheson, manager at Saltus Asset Management, noted, “Gilts are showing increased vulnerability due to the UK’s fiscal issues.”

The dollar-Canadian dollar rate fell to 1.4029 Canadian dollars, down 0.0087 Canadian dollars (0.616%) from the previous close.

Statistics Canada reported that Canada’s unemployment rate for October was 6.9%, below the market forecast of 7.1%.

Carl Shamotta, chief market strategist at Corpay, commented, “The Canadian dollar’s gains and rising bond yields reflect market expectations that the Bank of Canada may delay or even forgo rate cuts in its easing cycle.”

The offshore dollar-yuan (CNH) rate edged up to 7.1247 yuan, up 0.0028 yuan (0.039%) from the previous session.

jwchoi@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.