(Seoul=Yonhap Infomax) Sung Jin Kim = The US dollar weakened for the first time in six trading days, as expectations for a Federal Reserve rate cut next month surged, while the Bank of Japan (BOJ) continued to signal a potential rate hike. Despite ongoing concerns over Japan's fiscal health, the yen posted a rare sharp gain.

According to Yonhap Infomax (screen number 6411), as of 16:00 on the 21st (Eastern Time), the dollar-yen exchange rate in the New York foreign exchange market stood at 156.390 yen, down 1.187 yen (0.753%) from the previous session's New York close of 157.577 yen.

The euro-yen rate dropped 1.500 yen (0.826%) to 180.13 yen from 181.63 yen, ending a five-day rally and halting its streak of record highs.

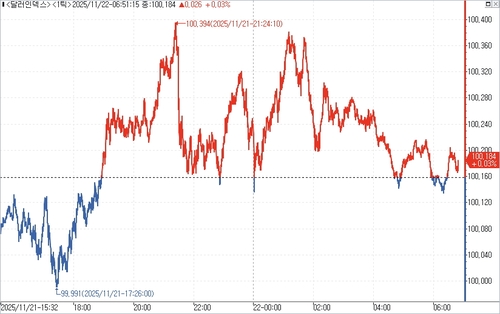

The dollar index (DXY), which measures the greenback against six major currencies, fell 0.094 points (0.094%) to 100.157 from 100.251. The index briefly dipped to 99.989 during European trading but quickly rebounded above the 100 mark after eurozone economic data came in slightly weaker than expected.

The euro-dollar rate slipped 0.00076 dollars (0.066%) to 1.15185 dollars from 1.15261 dollars, marking its sixth consecutive daily decline.

According to S&P Global and Hamburg Commercial Bank (HCOB), the eurozone's preliminary composite Purchasing Managers' Index (PMI) for November was 52.4, above the 50 threshold that separates expansion from contraction, but just below both the previous month's and market consensus of 52.5.

Following remarks by John Williams, President of the Federal Reserve Bank of New York and widely seen as the Fed's third most influential official, the probability of a rate cut next month priced into the futures market soared to 70%, sharply overtaking bets on a hold.

In a speech at the Central Bank of Chile's centennial conference earlier in the day, Williams stated, "I still see the possibility of further adjustments to the target range for the federal funds rate in the near term to move policy closer to neutral." He added, "Looking ahead, it is essential to return inflation to our 2% long-term goal on a sustained basis, but it is equally important to achieve this without creating excessive risks to our full employment objective."

The yen strengthened further against the dollar after comments from BOJ Policy Board member Kazuyuki Maes. In an interview with a local media outlet published at midnight Japan time on the 22nd, Maes said a rate hike decision is "getting closer." He added, "I can't say which month it will be, but in terms of distance, we are close."

Maes emphasized, "While many countries have policy rates above neutral, Japan's policy rate is below neutral, and I strongly believe it needs to be changed quickly."

Earlier in the day, BOJ Governor Kazuo Ueda told the Diet that if the Japanese economy and prices move as expected, the central bank will continue with rate hikes. "The likelihood of our outlook being realized is increasing," Ueda said, "and this is strengthening expectations for gradual policy normalization." The previous day, Policy Board member Junko Koeda argued that "real interest rates are negative and clearly low compared to other countries," underscoring the need for rate normalization.

Takeshi Minami, chief economist at Norinchukin Research Institute, cited these hawkish comments and assessed, "There is a high possibility that the BOJ will raise rates in December." He added, "The government does not want a weak yen and is likely to tolerate a rate hike to counter yen depreciation."

On the day, the pound-dollar rate rose 0.00351 dollars (0.269%) to 1.31051 dollars. The offshore dollar-yuan (CNH) rate fell 0.0136 yuan (0.191%) to 7.1047 yuan.

sjkim@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.