(New York=Yonhap Infomax) Jin Woo Choi – The US dollar extended its gains for a fourth consecutive trading day, though the advance was modest.

The greenback ended the session slightly higher, supported by lingering doubts over a potential Federal Reserve rate cut in December, even as US manufacturing data fell short of market expectations.

According to Yonhap Infomax (screen number 6411), as of 16:00 Eastern Time on the 3rd, the dollar-yen exchange rate stood at 154.195 yen, up 0.083 yen (0.054%) from the previous New York close of 154.112 yen.

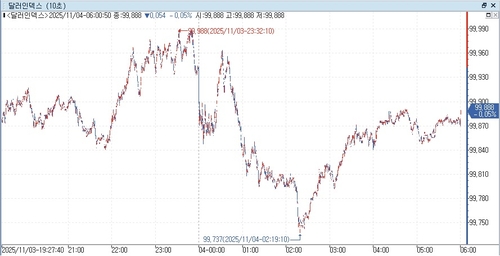

The dollar index (DXY), which measures the US currency against six major peers, rose 0.060 points (0.060%) to 99.871.

The dollar faced upward pressure in New York trading as markets digested hawkish remarks from key Fed officials last week.

On October 31, Dallas Fed President Lorie Logan and Cleveland Fed President Beth Hammack both voiced opposition to a rate cut at the October FOMC meeting. Both will hold voting rights on the FOMC starting next year.

Chicago Fed President Austan Goolsbee also signaled a cautious stance on further rate cuts, stating, "I am more concerned about inflation than the labor market."

Fed Governor Lisa Cook said that while the October FOMC rate cut was appropriate, "policy going forward is not on a predetermined path" regarding December.

In contrast, Fed Governor Steven Myron, a former economic adviser to President Donald Trump, argued that the Fed's monetary policy is too restrictive and called for additional rate cuts.

Shaun Osborne, Chief FX Strategist at Scotiabank, noted, "There is considerable skepticism about a December rate cut," adding, "Rarely has there been such open division within the Fed over the direction of monetary policy."

However, the impact of the Fed's hawkish tone was partially offset by weak US manufacturing data.

The Institute for Supply Management (ISM) reported that the US manufacturing Purchasing Managers' Index (PMI) fell to 48.7 in October, down 0.4 points from September's 49.1 and below the market consensus of 49.5.

The dollar index, which had climbed as high as 99.988 intraday, dropped to 99.737 following the PMI release before rebounding slightly to trade mostly in the 99.8 range late in the session.

Thomas Ryan, North America economist at Capital Economics, commented, "The slight decline in the October ISM manufacturing index is not a major concern, given the volatility in the production sector," adding, "New orders and employment showed modest improvement."

Unlike the US, eurozone manufacturing activity met market expectations.

According to S&P Global and Hamburg Commercial Bank (HCOB), the final eurozone manufacturing PMI for October came in at 50.0, matching both the preliminary reading and market forecasts.

Cyrus de la Rubia, Senior Economist at HCOB, assessed that "the eurozone's manufacturing sector has only just begun to show the faintest signs of economic recovery."

The euro-dollar exchange rate fell 0.00061 dollars (0.053%) to 1.15195 dollars. The offshore dollar-yuan (CNH) rate rose 0.0028 yuan (0.039%) to 7.1263 yuan.

The pound-dollar exchange rate edged up 0.00028 dollars (0.021%) to 1.31392 dollars.

The Bank of England (BOE) is set to hold its monetary policy meeting on the 6th to decide on interest rates.

Lee Hardman, FX strategist at Mitsubishi UFJ, said, "Our base case is for a December cut," but added, "A single softening in the Consumer Price Index (CPI) is not enough to justify a rate cut this time."

jwchoi@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.