(New York=Yonhap Infomax) Jin Woo Choi—The US dollar weakened in New York trading.

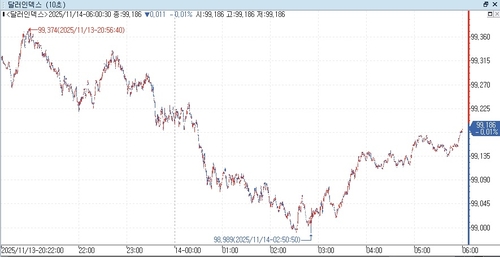

The US Dollar Index (DXY), which tracks the greenback against six major currencies, slid to the low 99 range as uncertainty mounted due to a lack of key economic data, briefly dipping below the 99 mark.

According to Yonhap Infomax (screen number 6411), as of 16:00 on the 13th (US Eastern Time), the dollar-yen exchange rate stood at 154.542 yen, down 0.206 yen (0.133%) from the previous New York close of 154.748 yen.

The euro-dollar rate rose to $1.16331, up $0.00434 (0.374%) from the previous session.

The Dollar Index fell 0.306 points (0.308%) to 99.181.

The dollar came under broad selling pressure in New York as market participants grappled with the absence of economic indicators, reflecting confusion over the so-called 'data blackout.'

Kevin Hassett, Chairman of the White House National Economic Council (NEC), told Fox News, "Because the household survey was not conducted in October, we will only receive half of the jobs report. We will get the employment component, but not the unemployment rate."

He added, "We probably won't know for sure what the unemployment rate was in October."

The lack of key economic data due to the government shutdown has heightened uncertainty over the Federal Reserve's policy rate trajectory.

According to CME FedWatch, as of 15:47 in New York, the federal funds rate (FFR) futures market priced in a 51.9% probability of a 25bp rate cut by the Fed in December, down more than 10 percentage points from 62.9% in the previous session.

This represents a near 'coin toss' scenario, with odds retreating to almost 50-50.

US assets—including the dollar, Treasuries, and equities—broadly weakened as uncertainty weighed on markets. The Dollar Index fell as low as 98.989 during intraday trading.

Juan Perez, Trading Director at Monex USA, said, "The shutdown is over, but how quickly will we return to normal? When will we get the numbers? When can we conduct accurate analysis based on reliable US statistics for September and October? All of this remains uncertain."

Seema Shah, Chief Global Strategist at Principal Asset Management, commented, "In an environment with limited information and conflicting trends that could develop in risky directions, portfolio flexibility is more important than bold conviction."

The pound-dollar rate rose to $1.31856, up $0.00553 (0.421%) from the previous session.

According to the UK Office for National Statistics (ONS), the country's GDP grew 0.1% quarter-on-quarter in Q3 (July–September), slowing from 0.3% in Q2 and missing market expectations of 0.2%.

The pound initially weakened following the GDP release but rebounded in tandem with the dollar's decline.

Scott Gardner, Investment Strategist at JP Morgan Personal Investing, noted, "Another weak GDP print is fueling debate over what policy levers the Prime Minister can pull to stimulate growth."

The offshore dollar-yuan (CNH) rate fell to 7.0980 yuan, down 0.0142 yuan (0.200%) from the previous session.

jwchoi@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.